Corporate Sellers Withholding Creators' PIT

09/17/2025

To facilitate Creator and Seller's tax compliance, TikTok Shop allows Corporate Sellers to choose to withhold Personal Income Tax from affiliate commissions from all Individual Creators and Multi-channel Networks (MCNs) who have Affiliate Service with the Sellers. Sellers are then responsible for declaring and remitting the PIT to tax authorities on behalf of Creators and MCNs. For clarity, the withholding transaction will be between the Corporate Sellers and relevant Creators in which TikTok Shop is not a party to such transaction.

IMPORTANT NOTE:

Within the scope of TikTok Shop, Creator PIT refers to the PIT on the incomes from wages and remunerations (affiliate commission) that Individual Creators and MCNs earn from affiliate activities with Corporate Sellers on the platform.

The default Creator PIT withholding rate is 7% on Creator's total affiliate commission. However, based on the service agreement between the Creator and the Seller and/or subject to the change of regulatory from time to time, the Seller may set the PIT rate between 0 and 35%.

Corporate Sellers' settlements on TikTok Shop will include their Creators' PIT that Sellers withheld.

Calculation illustration:

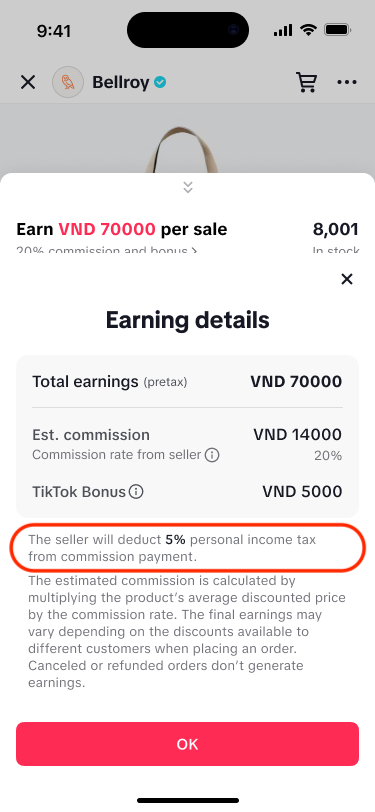

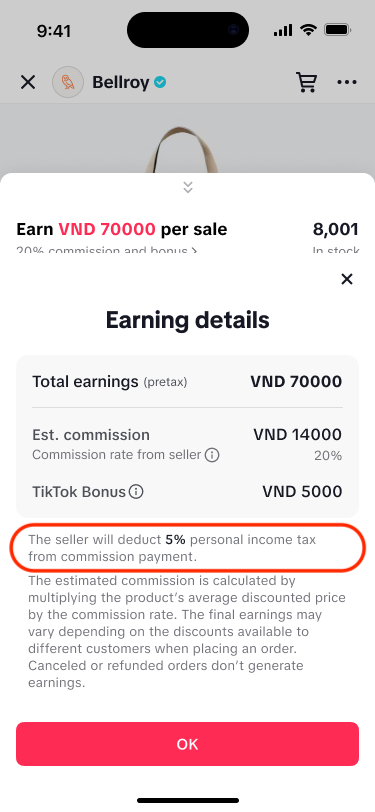

Creators will see the PIT withhold rate set by Sellers in the earnings details of the Product Details Page.

Creators will see the PIT withhold rate set by Sellers in the earnings details of the Product Details Page.

*Note: screenshots are for reference only. Actual rates and figures differ.Important Note: Once submitted, the PIT withhold rate can no longer be edited on the system. If Sellers entered a wrong PIT withhold rate by mistake, please reach out to the Account Manager or raise a ticket on the Help Center to edit the rate.

*Note: screenshots are for reference only. Actual rates and figures differ.Important Note: Once submitted, the PIT withhold rate can no longer be edited on the system. If Sellers entered a wrong PIT withhold rate by mistake, please reach out to the Account Manager or raise a ticket on the Help Center to edit the rate.

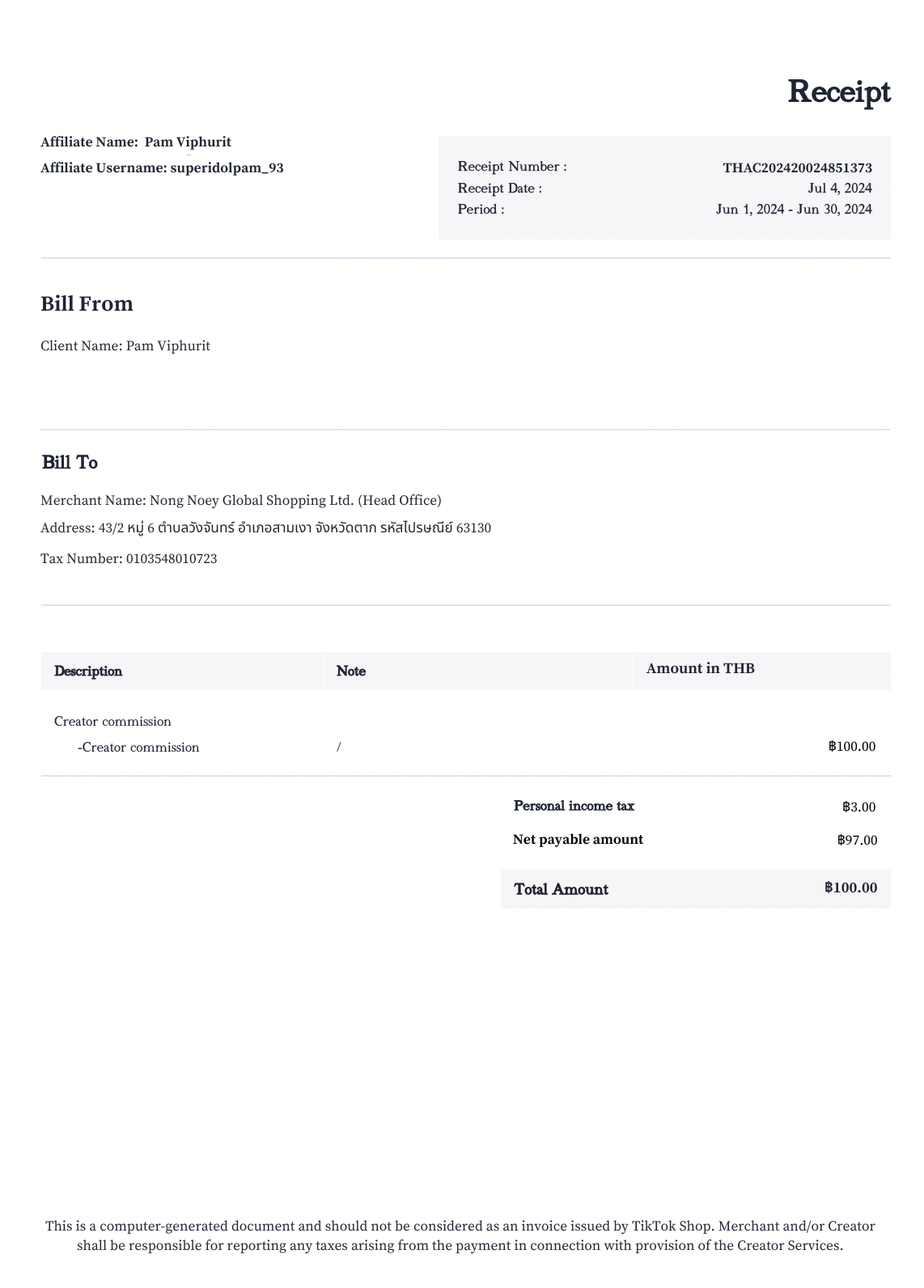

*Note: screenshots are for reference only. Actual rates and figures differ.Sellers may also find the PIT Withhold reflected in their monthly invoice.

*Note: screenshots are for reference only. Actual rates and figures differ.Sellers may also find the PIT Withhold reflected in their monthly invoice.

*Note: screenshots are for reference only. Actual rates and figures differ.

*Note: screenshots are for reference only. Actual rates and figures differ.

Important: Once submitted, the PIT withhold rate can no longer be edited on the system. If Sellers entered a wrong PIT withhold rate by mistake, please reach out to the Account Manager or raise a ticket on the Help Center to edit the rate.

The platform is not responsible for Sellers' and Creators' failed compliance.

TikTok cannot advise you on tax matters. For further questions on tax issues, please consult your tax advisor, Tax Authority help center services, or visit the Thailand Tax Authority website.

IMPORTANT NOTE:

- Creator Personal Income Tax withholding does NOT concern Business Household Sellers and Individual Sellers.

- A small number of Business Household Sellers might be mistakenly self-classified as Corporate Sellers on the platform and may still have access to the Creator Personal Income Tax withholding setting page. If you are a seller who falls into this case, please do NOT set any withholding rate, and you may reach out to our support team.

- This feature is currently available for only a few sellers.

What is Creator Personal Income Tax?

Personal Income Tax (“PIT”) is a direct tax, subject to levy on individual’s income of salary, wages and other sources.Within the scope of TikTok Shop, Creator PIT refers to the PIT on the incomes from wages and remunerations (affiliate commission) that Individual Creators and MCNs earn from affiliate activities with Corporate Sellers on the platform.

The default Creator PIT withholding rate is 7% on Creator's total affiliate commission. However, based on the service agreement between the Creator and the Seller and/or subject to the change of regulatory from time to time, the Seller may set the PIT rate between 0 and 35%.

How is the Creator Personal Income Tax withheld?

Creator PIT will be withheld by Corporate Sellers, who are then responsible for tax declaration on behalf of the Creator to tax authorities.Corporate Sellers' settlements on TikTok Shop will include their Creators' PIT that Sellers withheld.

Calculation illustration:

Assuming the Creator sold an order of THB 1,000,000 for the Seller.

| |

| Creator's gross affiliate commission (= order value * affiliate commission rate) | VND 1.000.000 * 20% = VND 200.000 |

| Creator's PIT (= creator's affiliate gross commission * tax rate) | VND 200.000 * 7% = VND 14.000 |

| Creator's net affiliate commission (= gross affiliate commission - creator's PIT) | VND 200.000 - VND 14.000 = VND 186.000 |

| Seller's settlement (= seller's settlement after commission + creator's PIT) | VND 1.000.000 * 80% + VND 14.000 = VND 814.000 |

| *The Seller is responsible for declaring and remitting the PIT to tax authorities on behalf of the Creator. | |

How can Sellers set Creator's PIT Withhold rate?

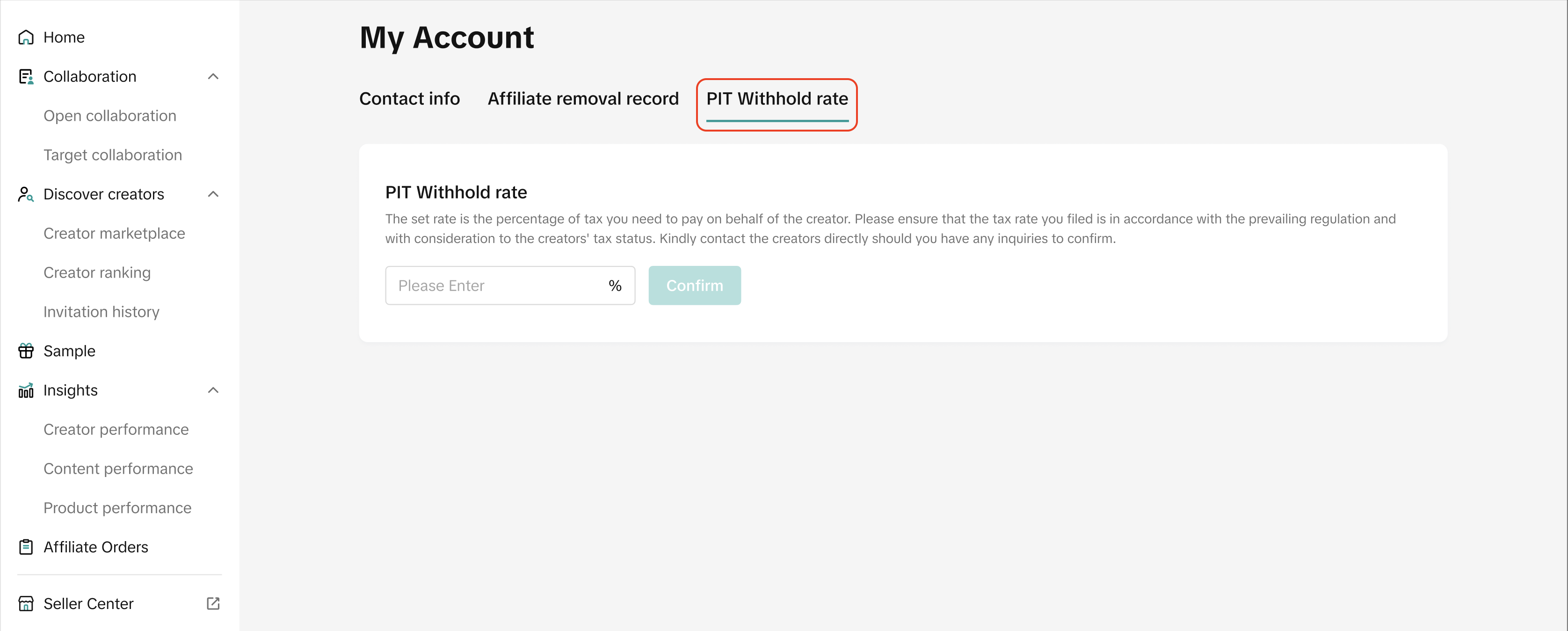

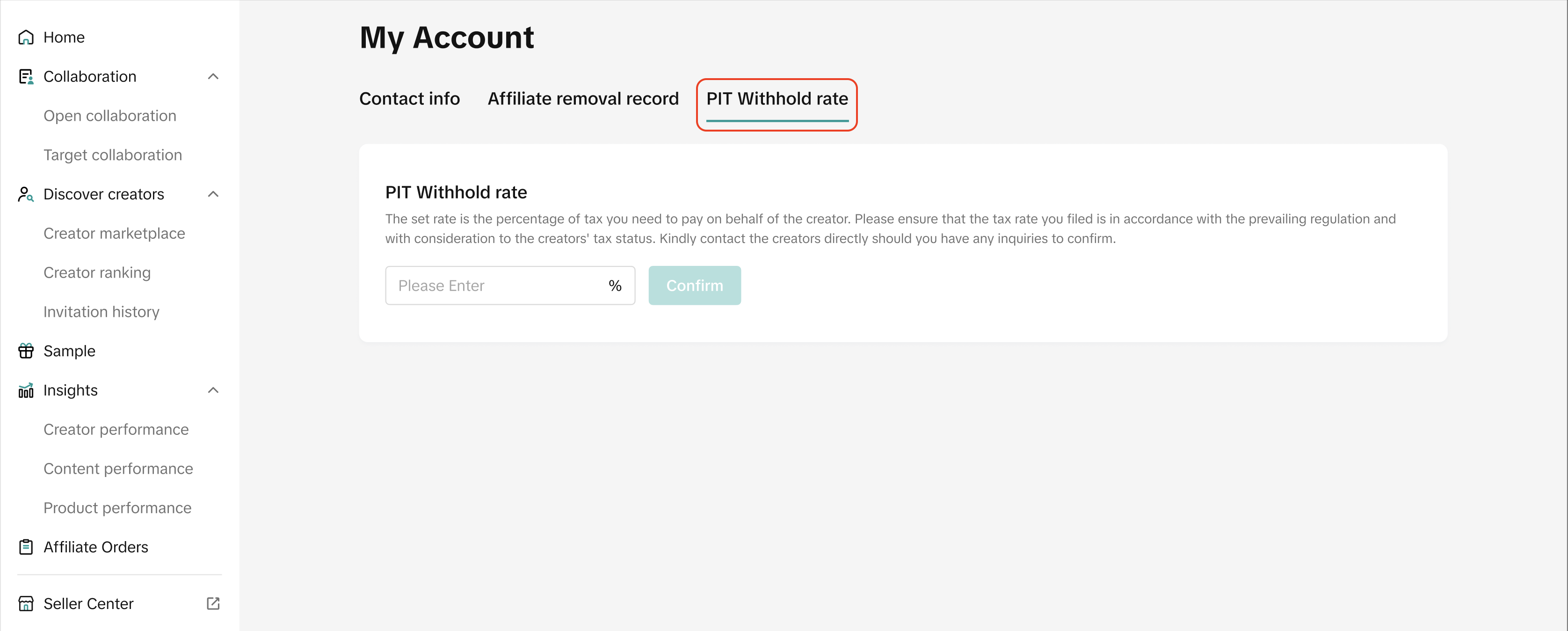

Sellers can set Creator's PIT rate by going to the Affiliate Center > Account > PIT Withhold rate. Creators will see the PIT withhold rate set by Sellers in the earnings details of the Product Details Page.

Creators will see the PIT withhold rate set by Sellers in the earnings details of the Product Details Page.  *Note: screenshots are for reference only. Actual rates and figures differ.Important Note: Once submitted, the PIT withhold rate can no longer be edited on the system. If Sellers entered a wrong PIT withhold rate by mistake, please reach out to the Account Manager or raise a ticket on the Help Center to edit the rate.

*Note: screenshots are for reference only. Actual rates and figures differ.Important Note: Once submitted, the PIT withhold rate can no longer be edited on the system. If Sellers entered a wrong PIT withhold rate by mistake, please reach out to the Account Manager or raise a ticket on the Help Center to edit the rate.

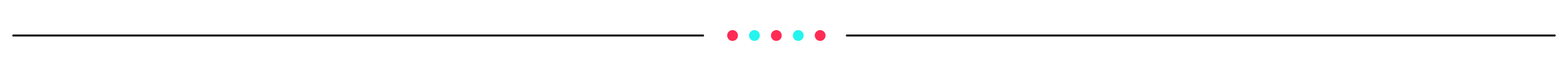

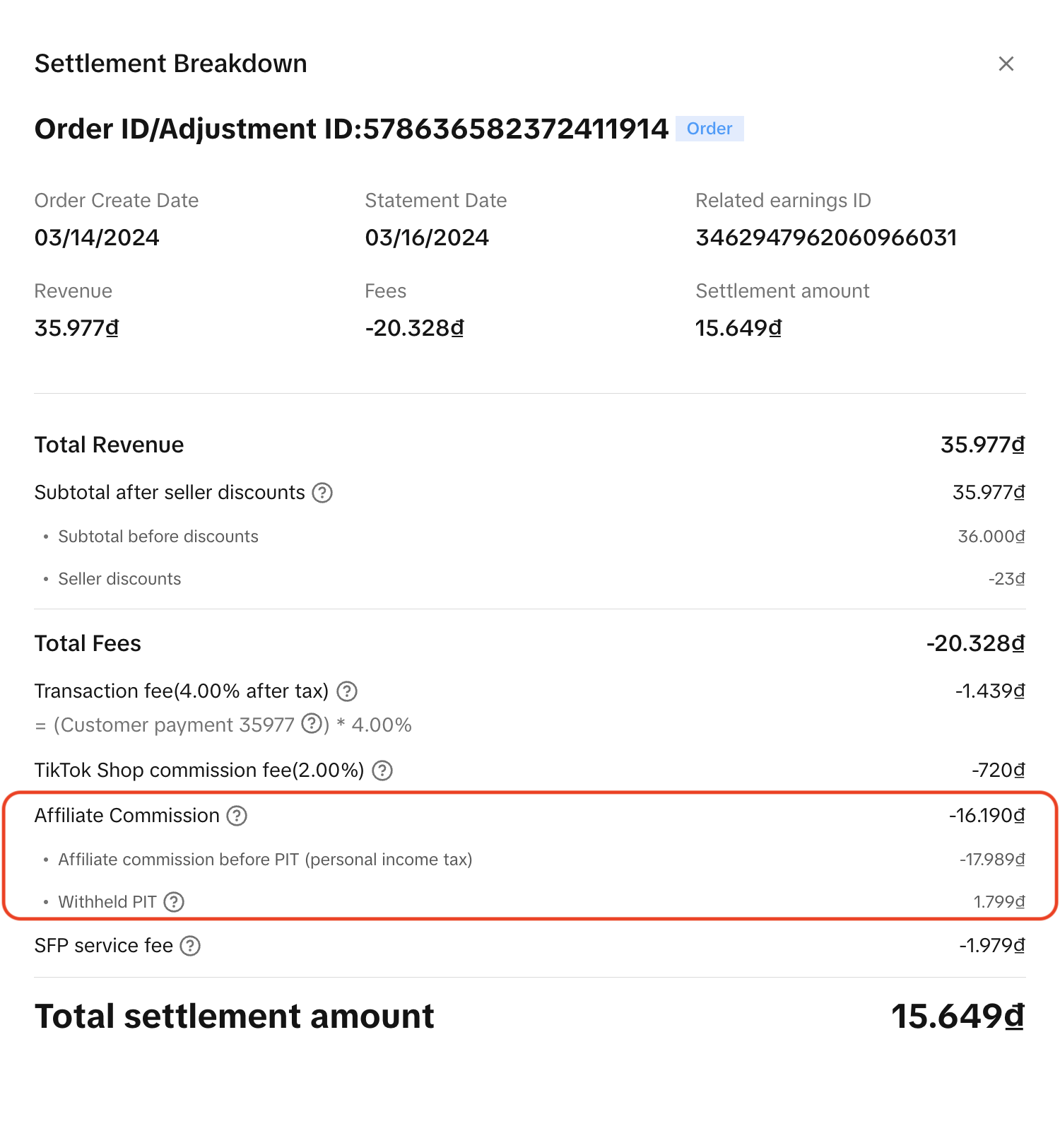

Where can Sellers find details of their Creator's PIT Withholding?

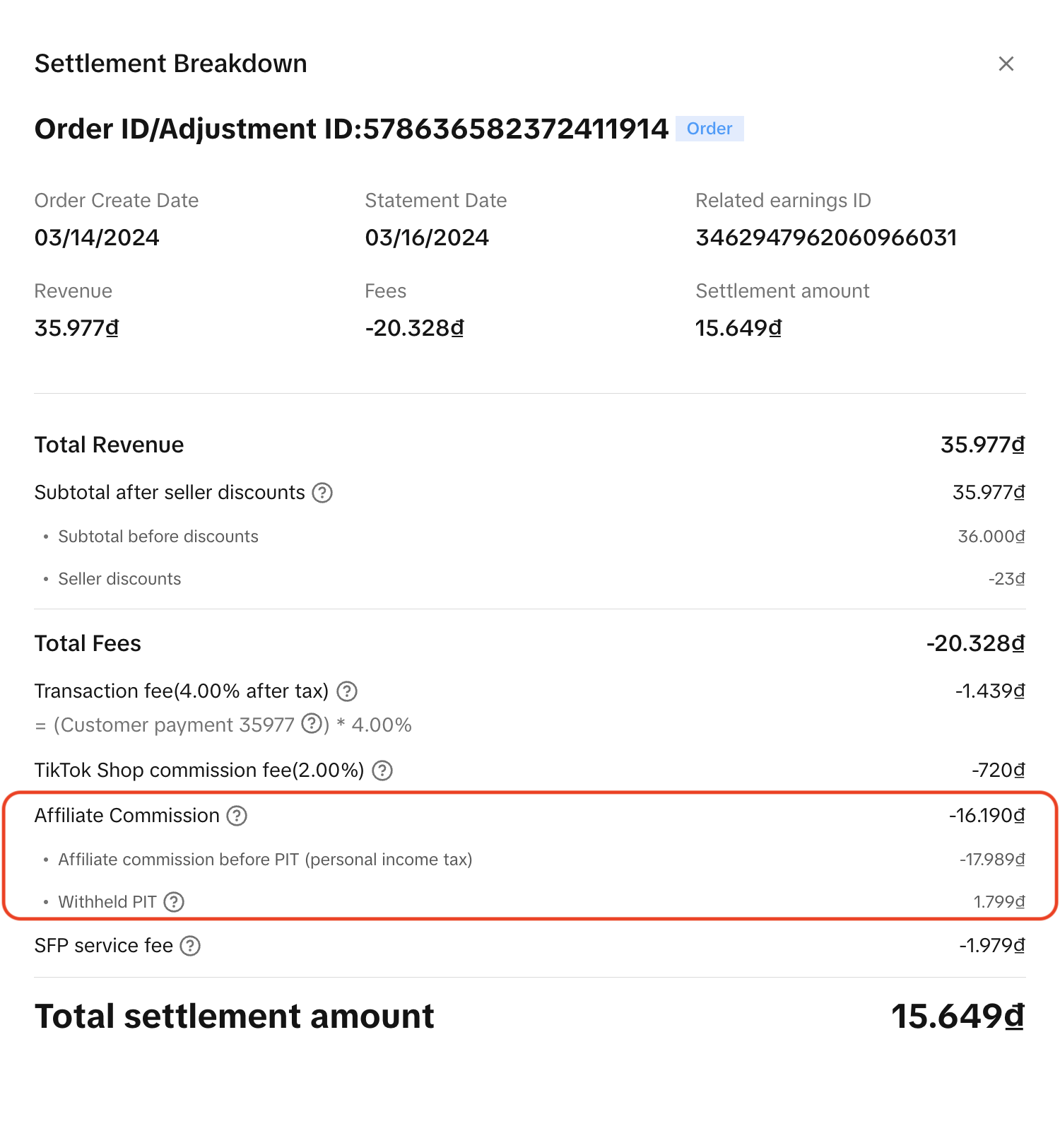

Sellers may find details of their Creator's PIT Withholding on the details of each Transaction under the Finance Module on the Seller Center. *Note: screenshots are for reference only. Actual rates and figures differ.Sellers may also find the PIT Withhold reflected in their monthly invoice.

*Note: screenshots are for reference only. Actual rates and figures differ.Sellers may also find the PIT Withhold reflected in their monthly invoice. *Note: screenshots are for reference only. Actual rates and figures differ.

*Note: screenshots are for reference only. Actual rates and figures differ.

FAQ

- How much is Creator PIT?

Important: Once submitted, the PIT withhold rate can no longer be edited on the system. If Sellers enter

- Which group of Sellers should pay attention to the PIT withholding?

- How should Sellers treat the withheld PIT amount?

The platform is not responsible for Sellers' and Creators' failed compliance.

TikTok cannot advise you on tax matters. For further questions on tax issues, please consult your tax advisor, Tax Authority help center services, or visit the Thailand Tax Authority website.