Credit Card Installment Payment

02/23/2026

[Updates 21 Feb 2026]

Reduced min spend by tenure by bank starting 1 Apr 2025:

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

*Important Note:

After turning on the credit card installment payment option, sellers may select the tenures they would like to offer their customers. They may choose among four options: 3, 4, 6 or 10 monthly installments.

After turning on the credit card installment payment option, sellers may select the tenures they would like to offer their customers. They may choose among four options: 3, 4, 6 or 10 monthly installments.

After choosing and saving tenures, CC IPP with the selected tenures will be applied to all products in their TikTok Shop.

After choosing and saving tenures, CC IPP with the selected tenures will be applied to all products in their TikTok Shop.

*Note: screenshots are for reference only. Actual rates, data and figures differ.

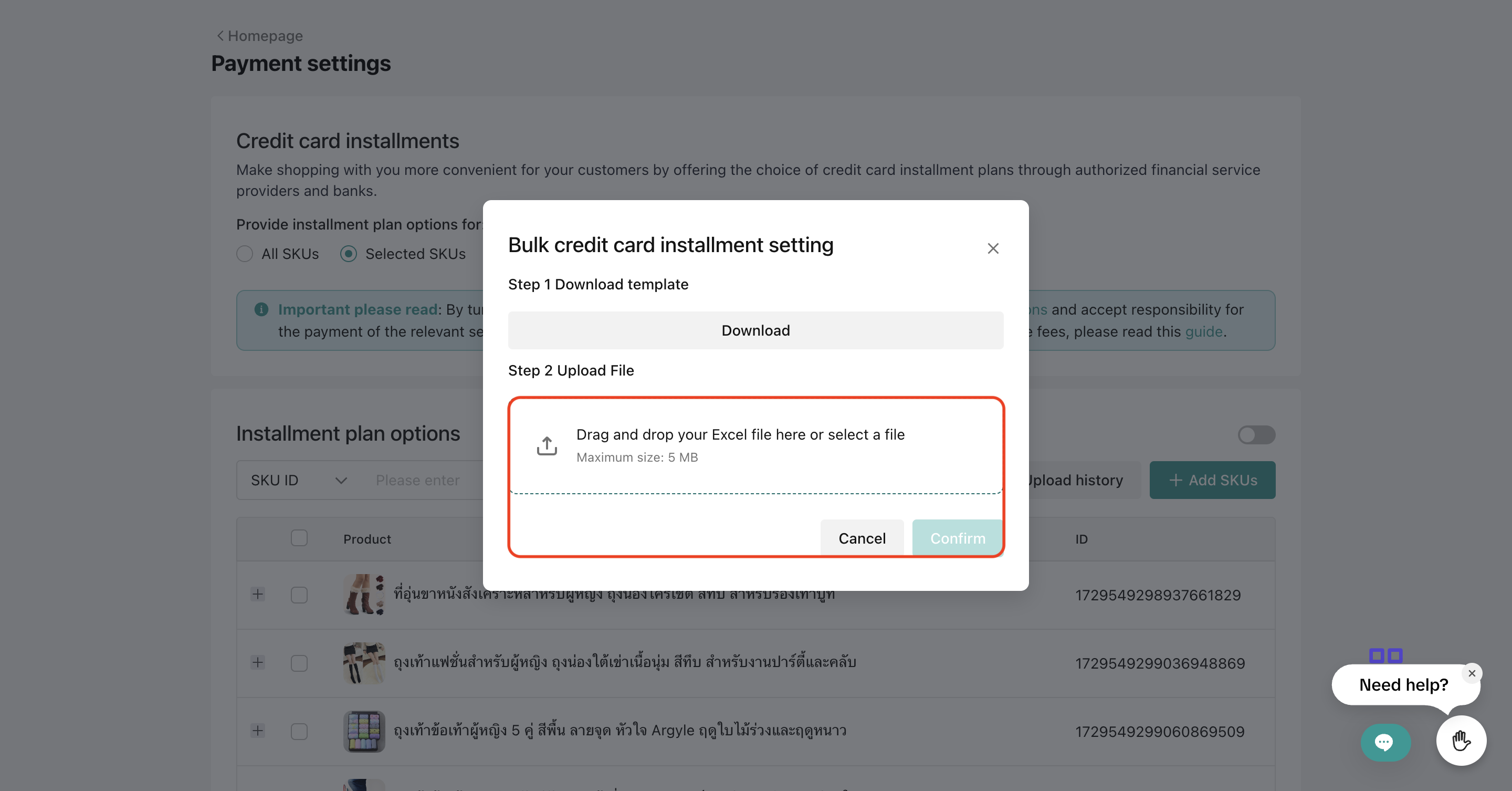

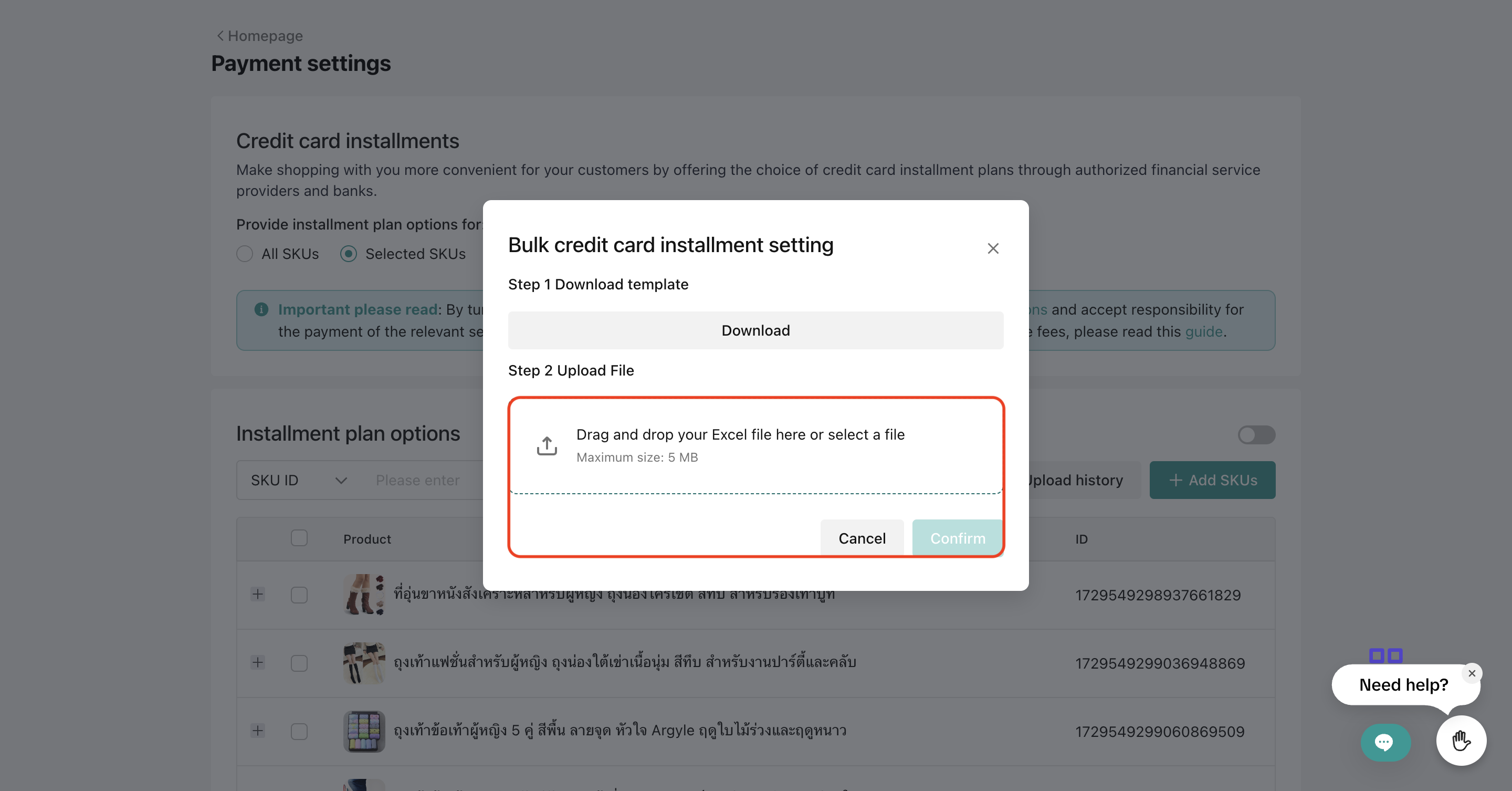

A window will pop up, where sellers can download the configuration template.

A window will pop up, where sellers can download the configuration template.

Fill in the template

Fill in the template

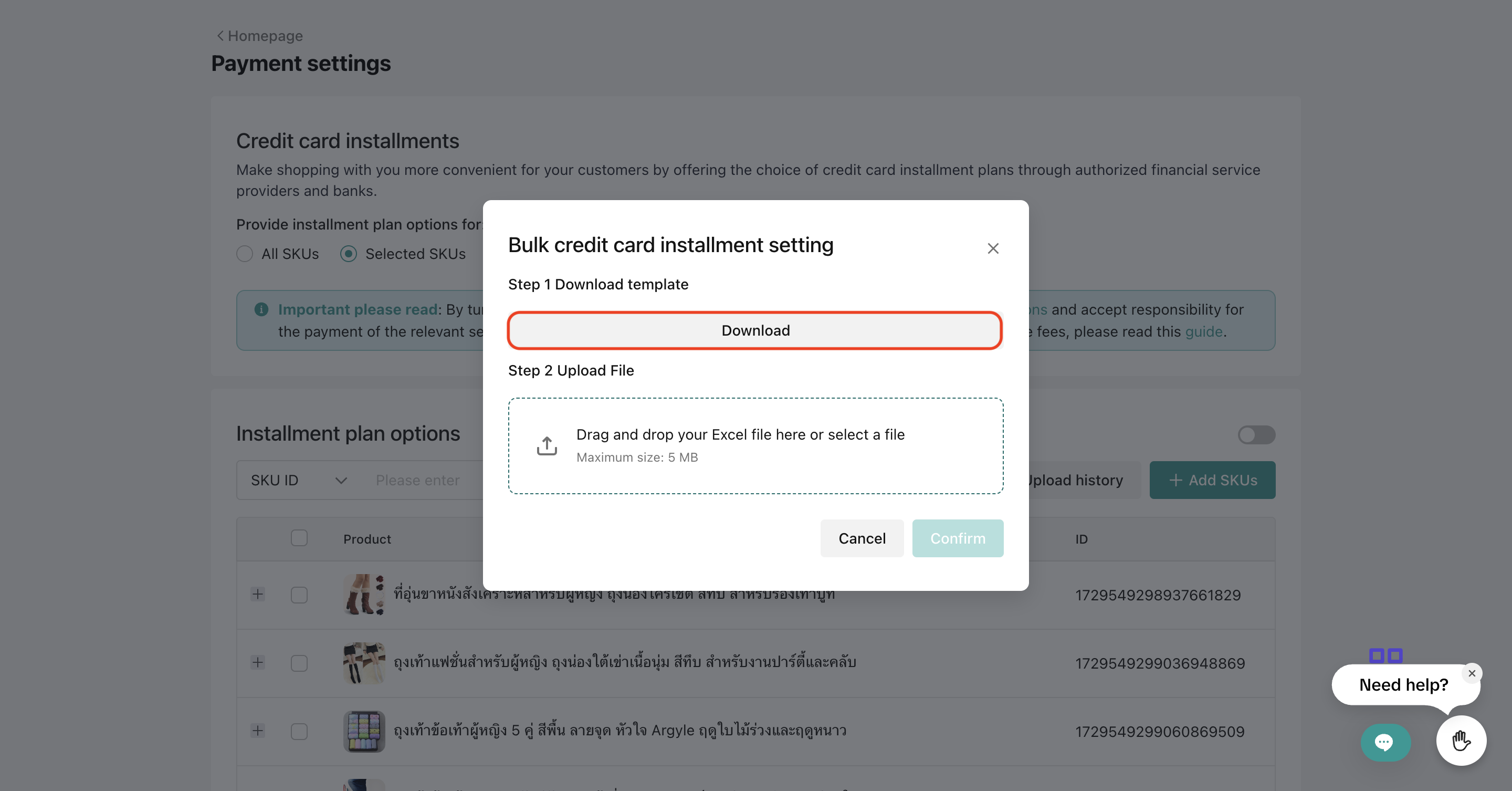

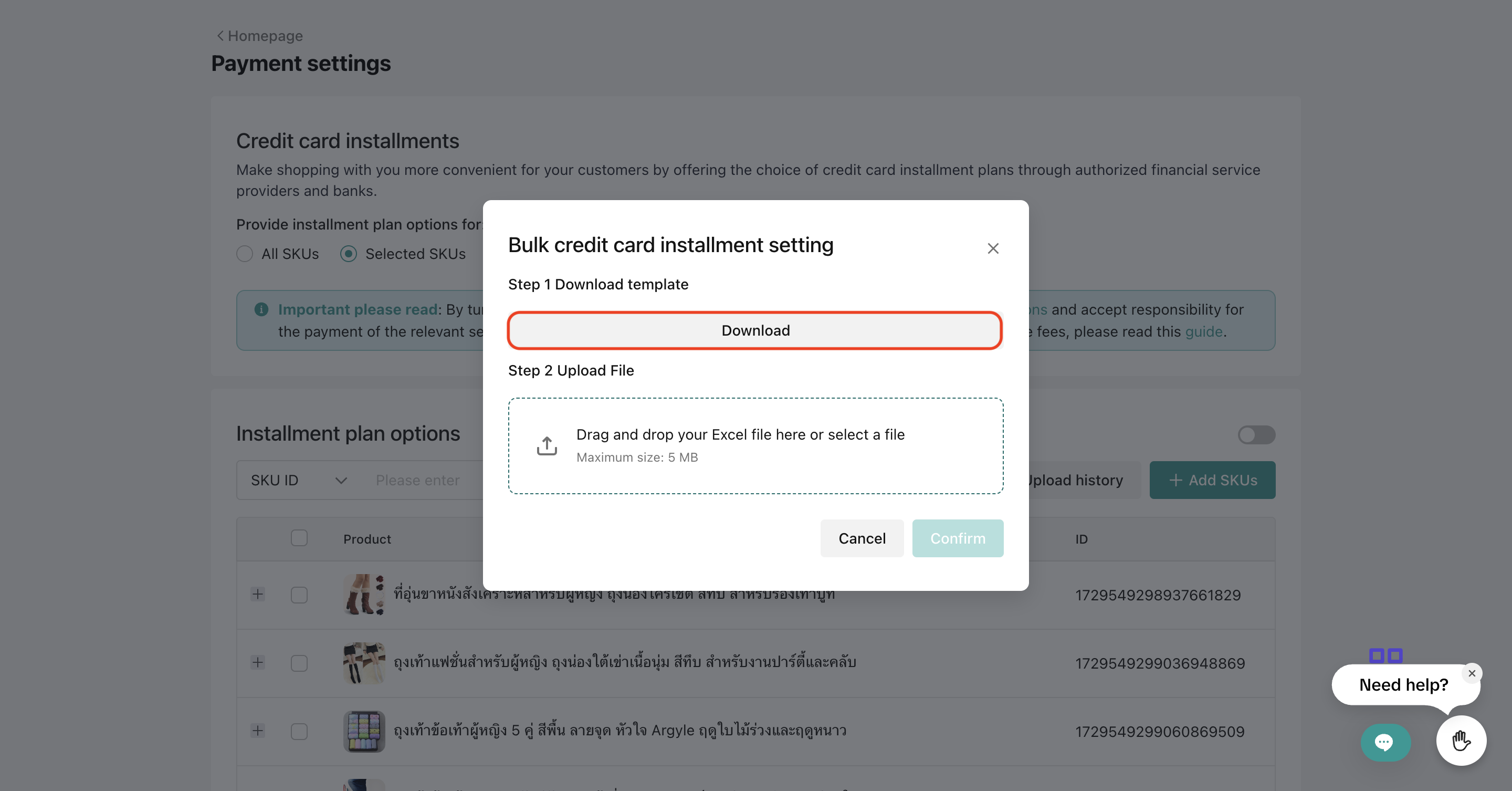

After filling out the template and checking all details, upload the file and confirm.

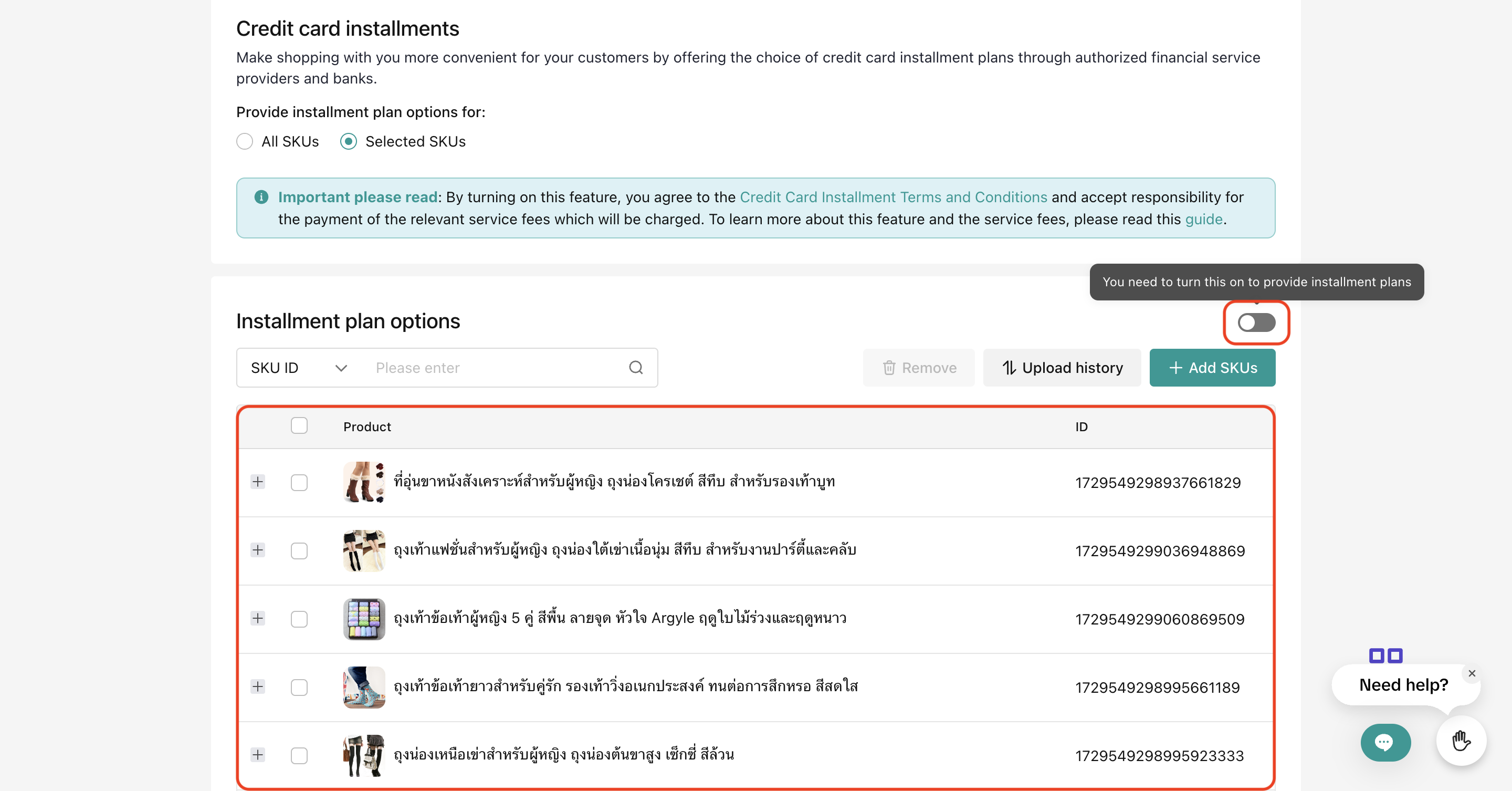

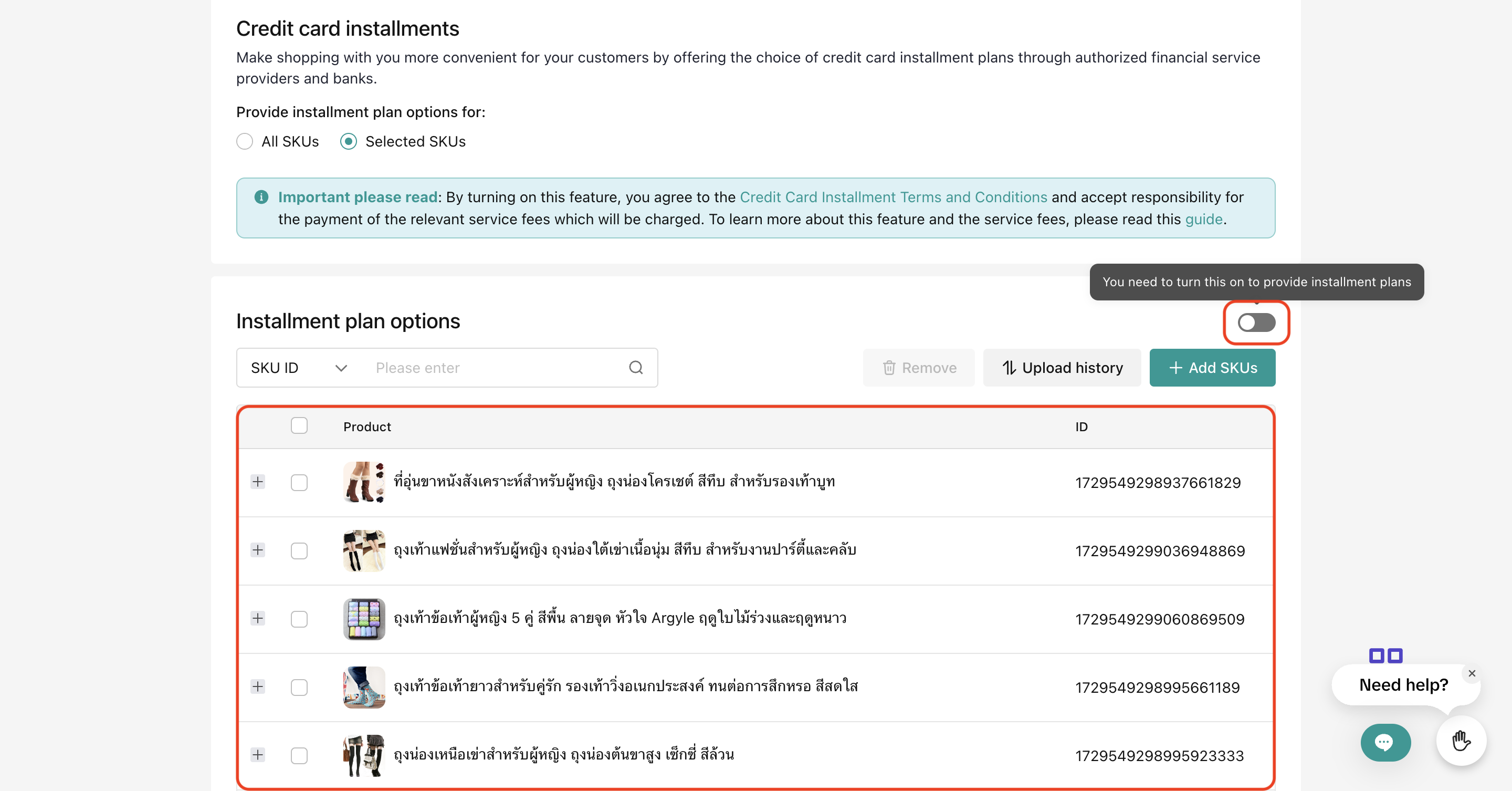

All selected SKUs will then appear under installment plan options. Turn on the toggle to offer CC IPP for this list of SKUs. The tenures offered to each SKUs may be different, depending on the information provided in the template.

All selected SKUs will then appear under installment plan options. Turn on the toggle to offer CC IPP for this list of SKUs. The tenures offered to each SKUs may be different, depending on the information provided in the template.

*Note: screenshots are for reference only. Actual rates, data and figures differ.

*Note: screenshots are for reference only. Actual rates, data and figures differ.

*Note: Other than the credit card installment interest, orders paid via CC IPP, like all orders, are also subject to the marketplace commission fee and transaction fee. Learn more here.

*Important Note: The Credit Card Installment Interest is inclusive of Thailand taxes. If you are a tax registered organisation in Thailand and your Tax Code has been provided to and verified by TikTok, we will only collect the amount exclusive of taxes. Learn more here.

*Important Note: The Credit Card Installment Interest is inclusive of Thailand taxes. If you are a tax registered organisation in Thailand and your Tax Code has been provided to and verified by TikTok, we will only collect the amount exclusive of taxes. Learn more here.

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

- Starting 1st of Jan 2025, fees for CC IPP will be lowered

- Staring 21 Feb 2026, Sellers who choose to enable the credit card installment option (CC IPP) will be charged a credit card installment interest fee for successfully delivered orders.

What is Credit Card Installment Payment?

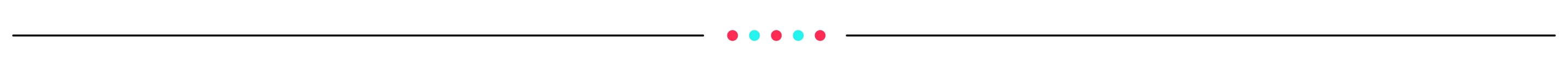

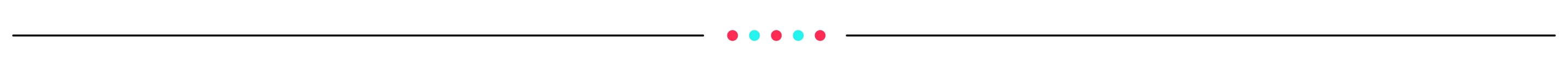

The Credit Card Installment Payment Plan (CC IPP) is an option of payment that is offered to all customers, in order to facilitate their needs to split high-value orders into more manageable monthly payments. Through this initiative, the platform aims to help sellers meet the needs of more customers and improve conversion rate, especially for high-value orders.How customers see CC IPP

The minimum spend will depend on the tenure (and starting 24 Oct 2024, bank used). Users will be able to see CC IPP options available for them during checkouts.Reduced min spend by tenure by bank starting 1 Apr 2025:

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

How Sellers Opt in for CC IPP

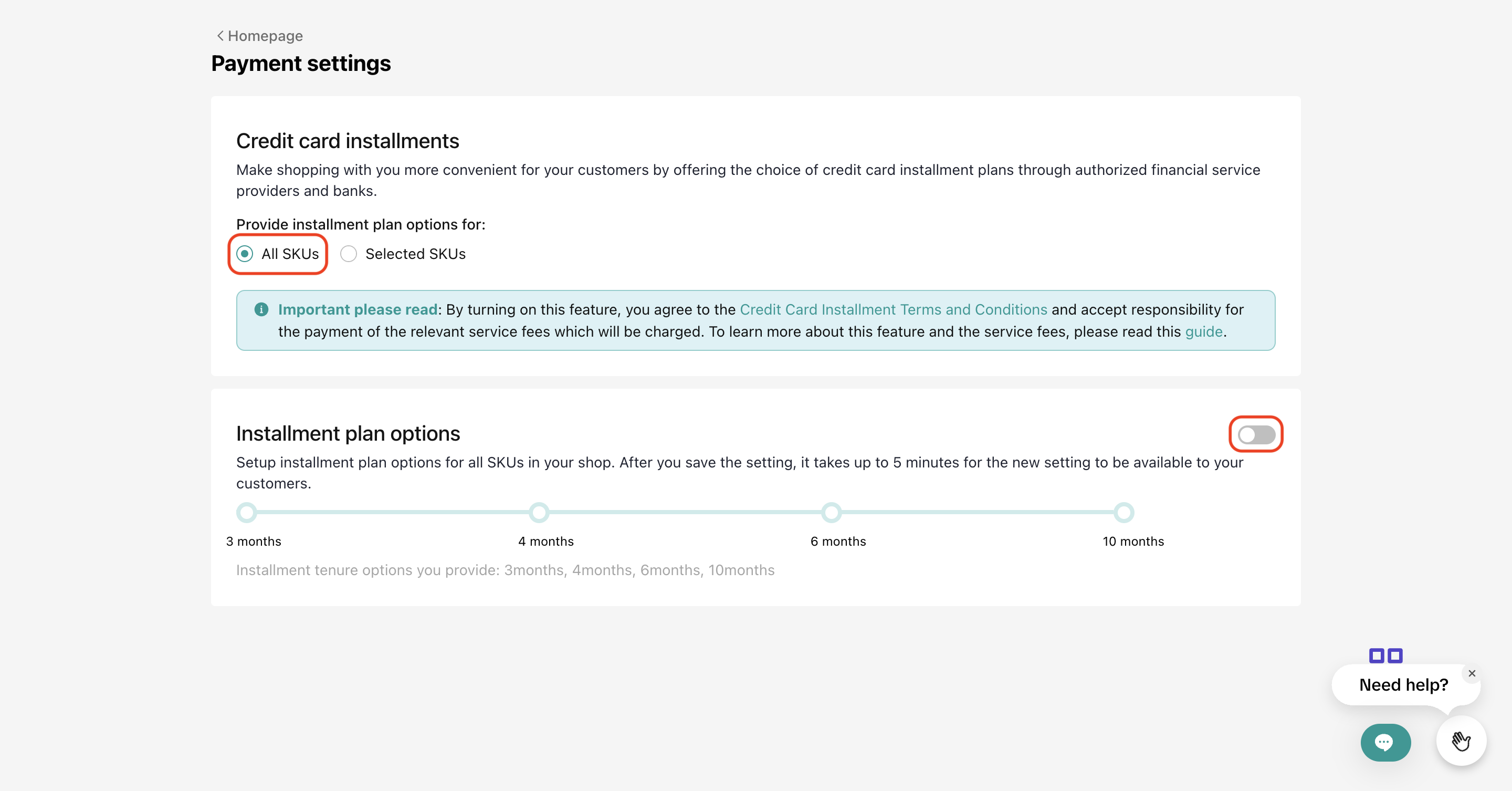

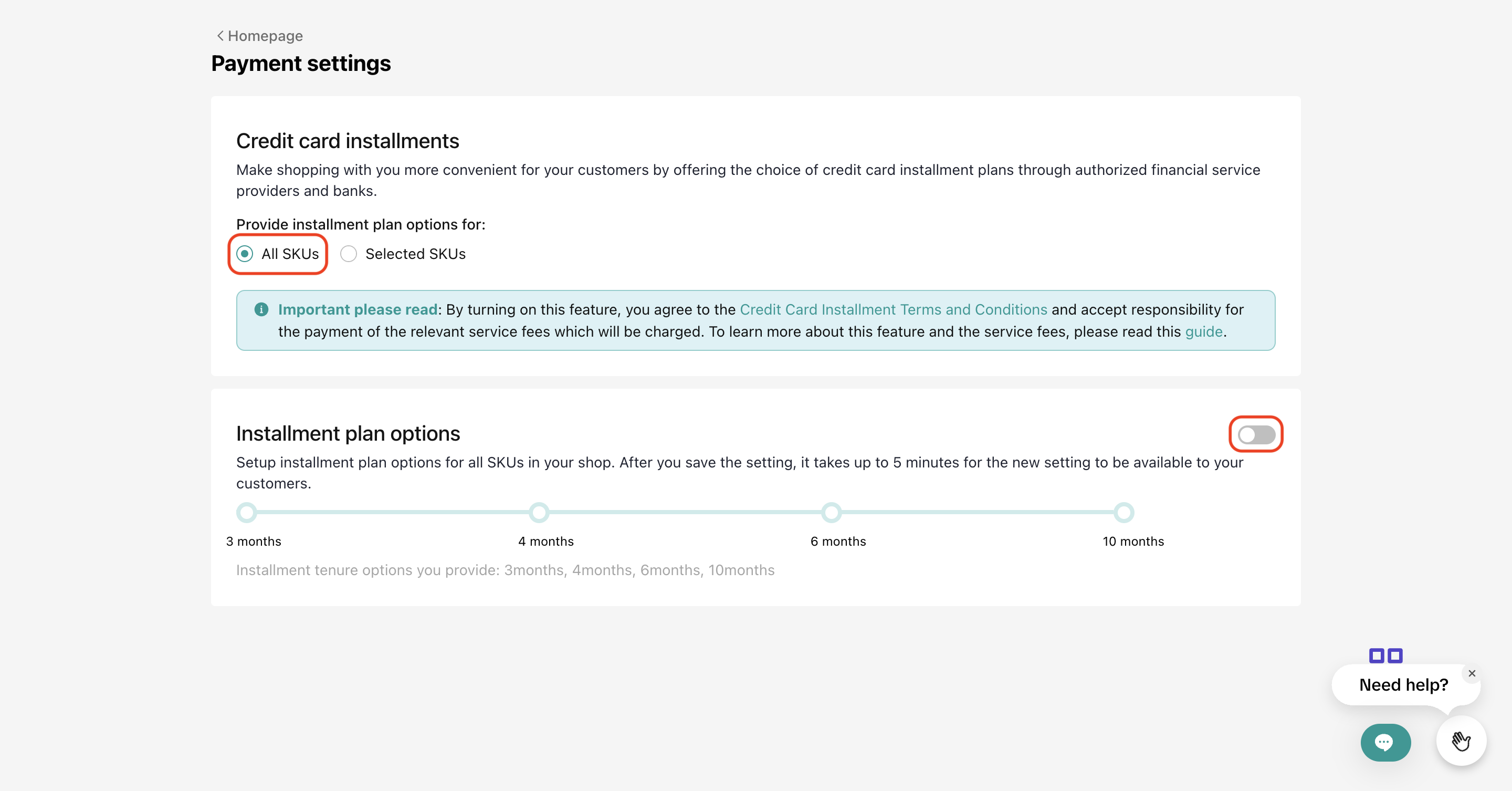

Sellers can choose to opt in to offer this payment method to their customers in the Seller Center > Finance > Payment Settings. Sellers may choose to turn CC IPP on for all SKUs, or for selected SKUs only.*Important Note:

- Before turning on CC IPP, please read carefully its terms and conditions here.

- Purchases made with CC IPP are charged an installment interest, aside the usual Commission Fee and Transaction Fee. Please see below for details of the installment interest.

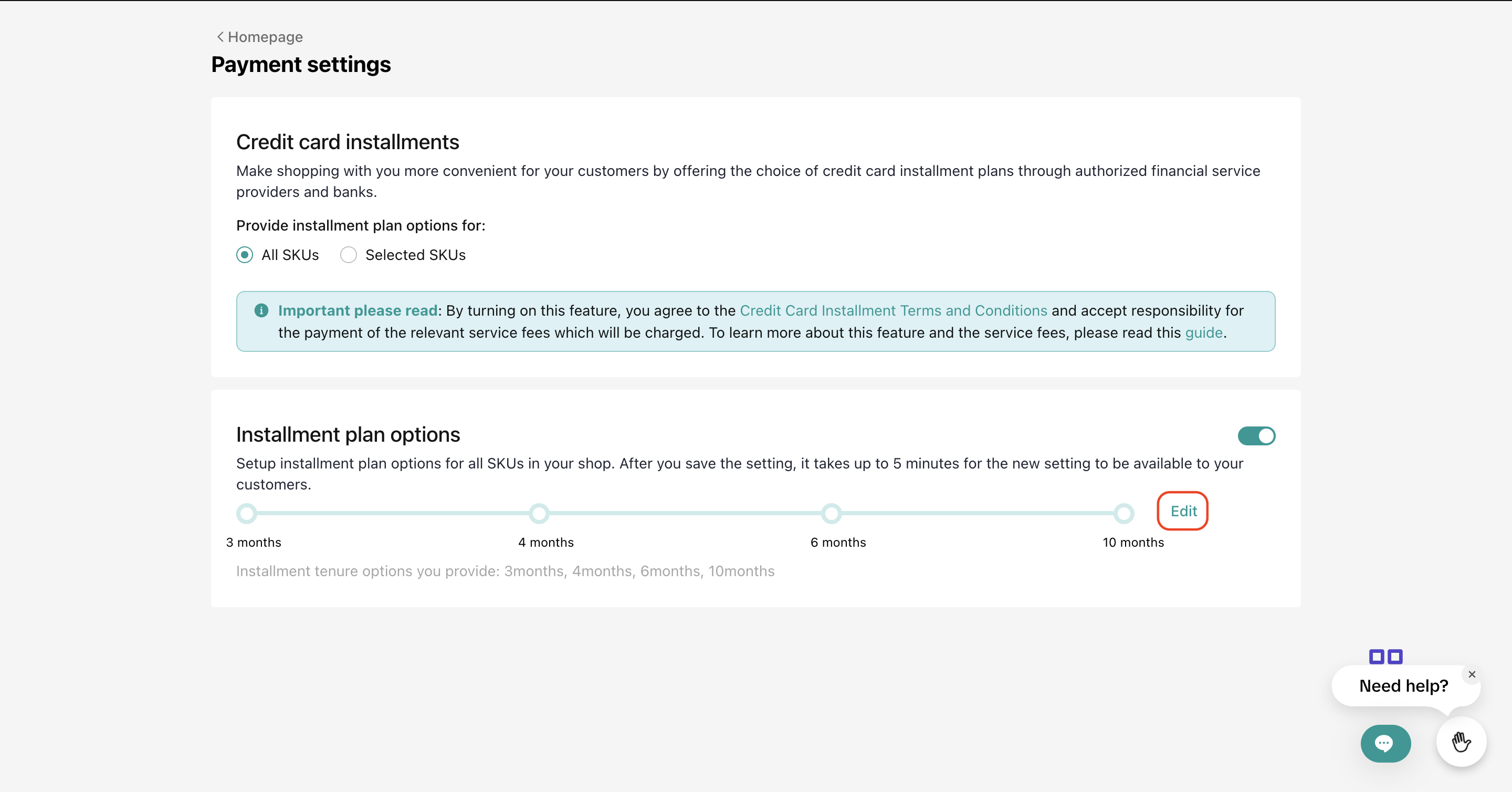

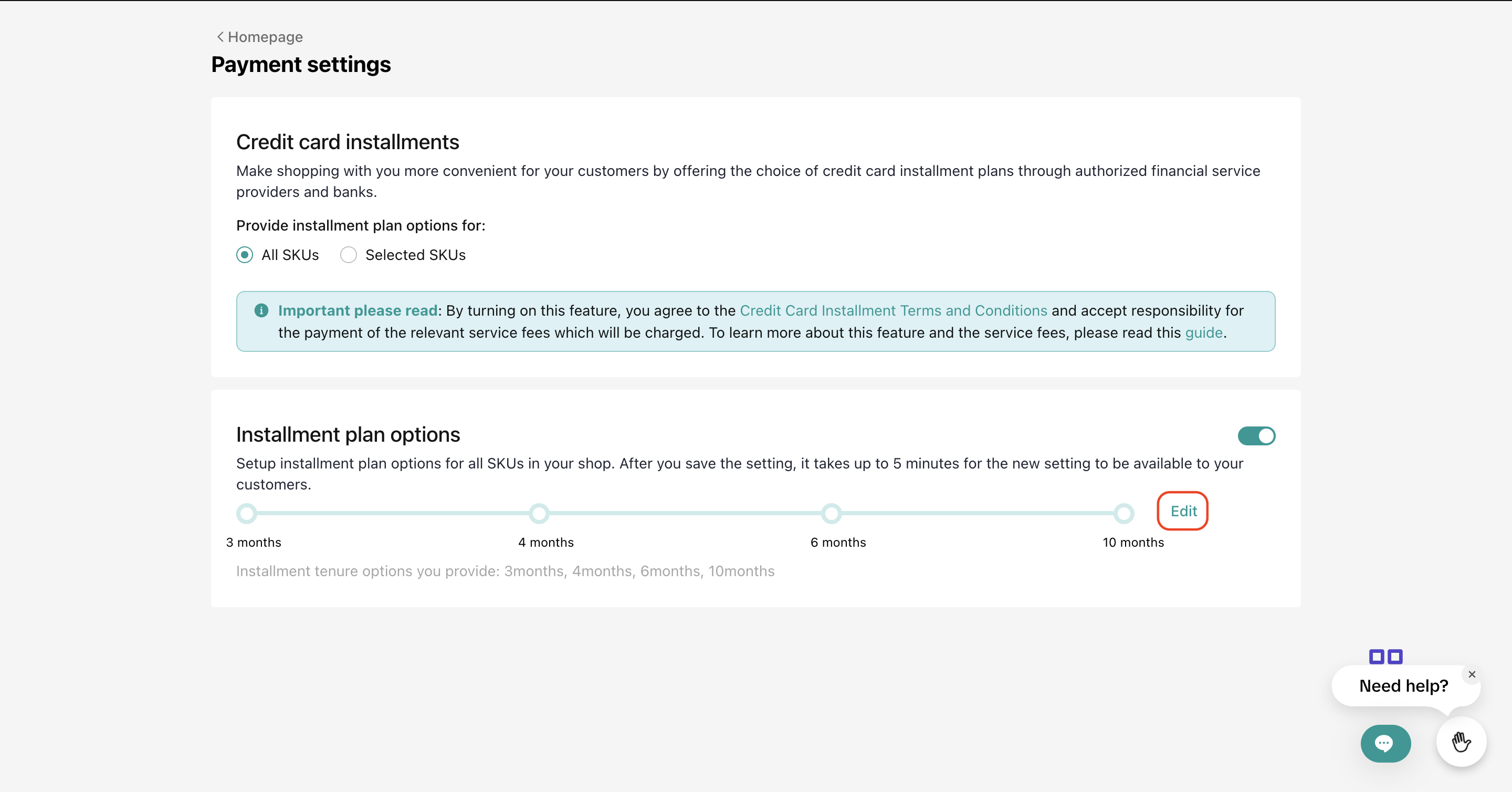

Enable CC IPP for All SKUs in the Shop

To enable CC IPP for all SKUs in the shop, select "All SKUs", then turn on the toggle. After turning on the credit card installment payment option, sellers may select the tenures they would like to offer their customers. They may choose among four options: 3, 4, 6 or 10 monthly installments.

After turning on the credit card installment payment option, sellers may select the tenures they would like to offer their customers. They may choose among four options: 3, 4, 6 or 10 monthly installments. After choosing and saving tenures, CC IPP with the selected tenures will be applied to all products in their TikTok Shop.

After choosing and saving tenures, CC IPP with the selected tenures will be applied to all products in their TikTok Shop.*Note: screenshots are for reference only. Actual rates, data and figures differ.

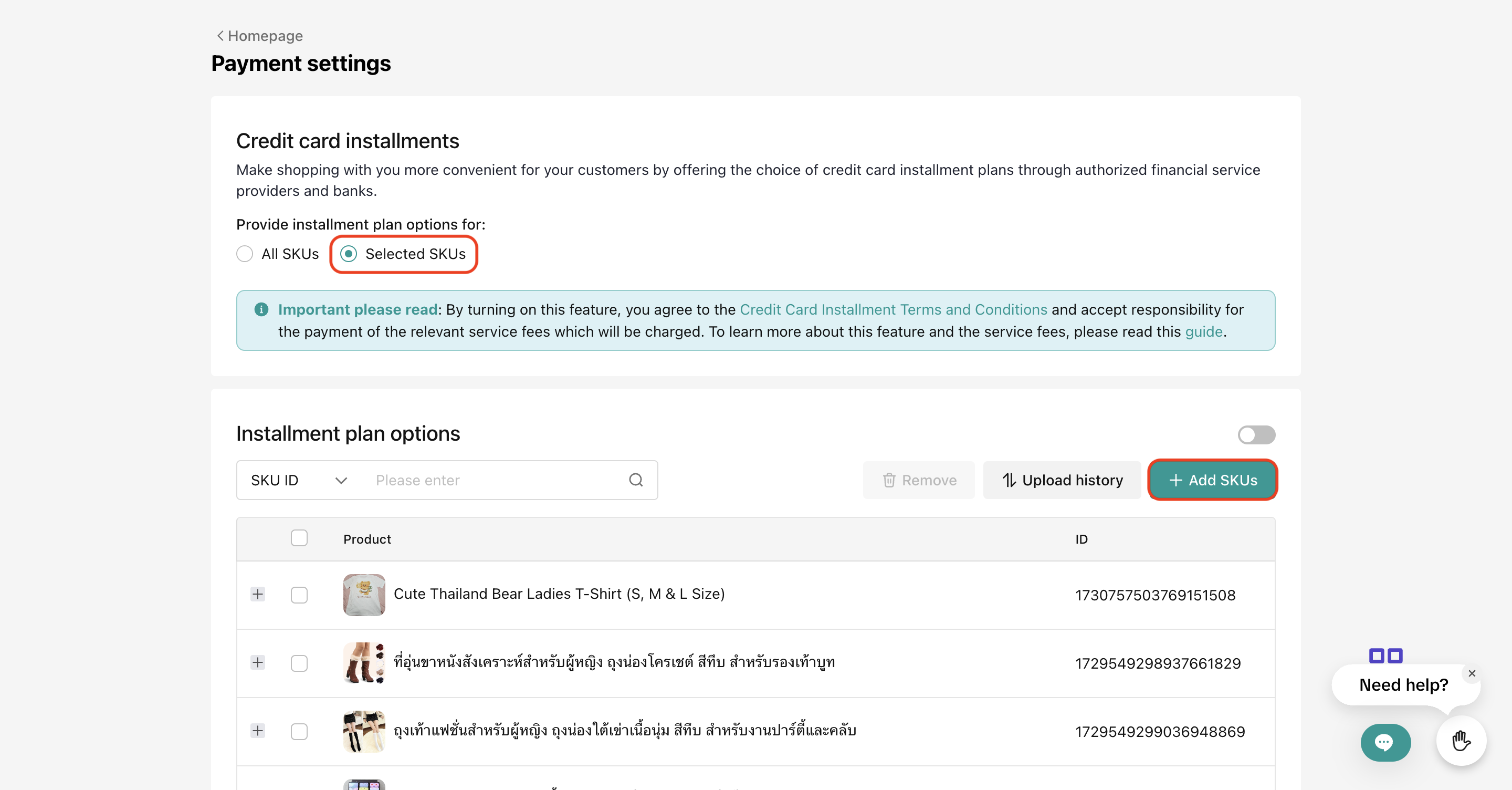

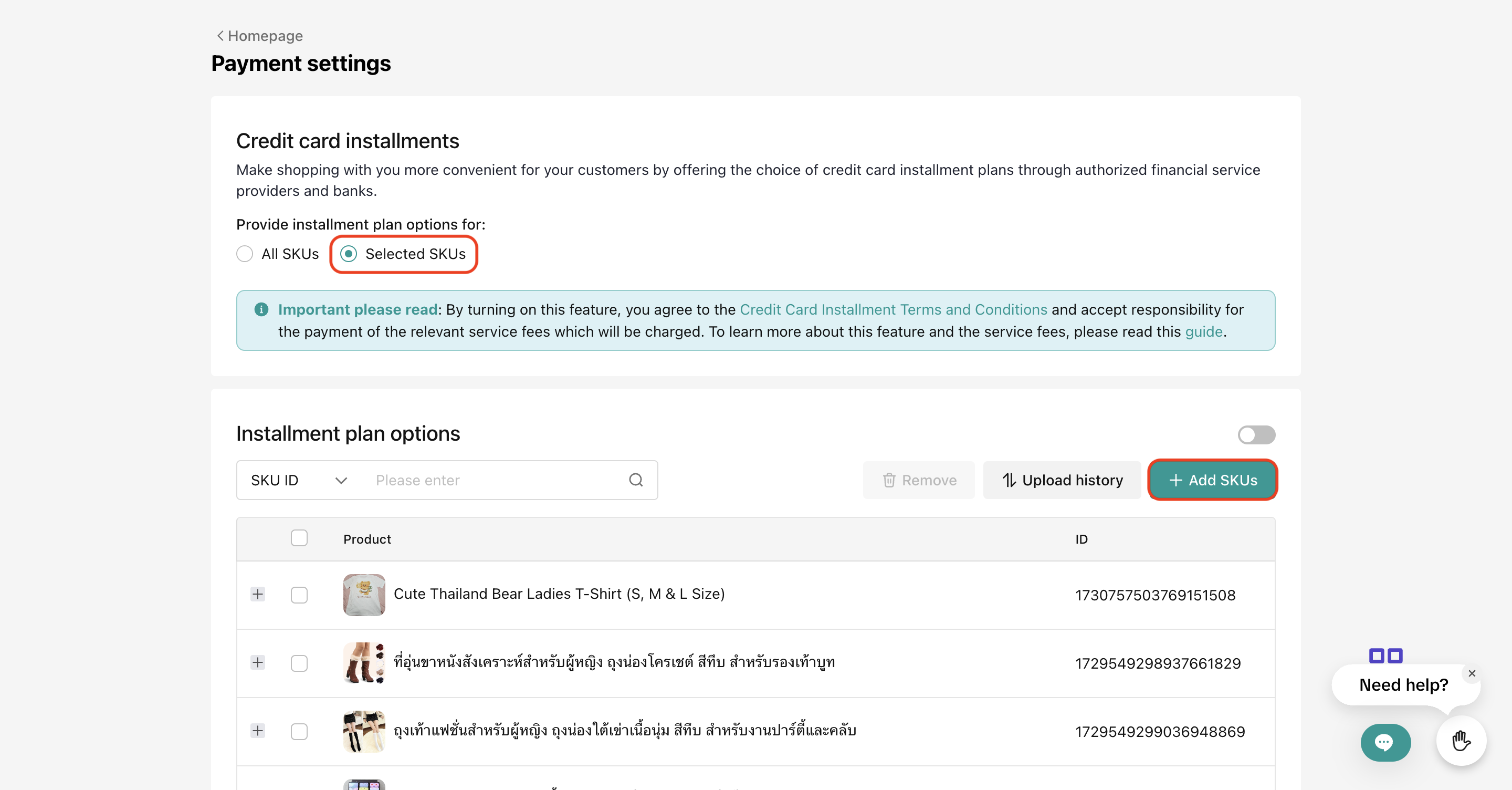

Enable CC IPP for Selected SKUs in the Shop

To enable CC IPP for all SKUs in the shop, select "Selected SKUs", then click "Add SKUs". A window will pop up, where sellers can download the configuration template.

A window will pop up, where sellers can download the configuration template. Fill in the template

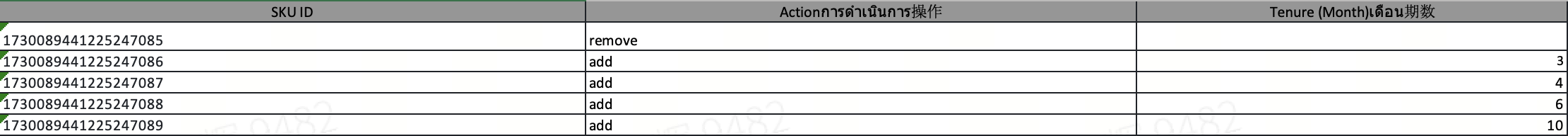

Fill in the template

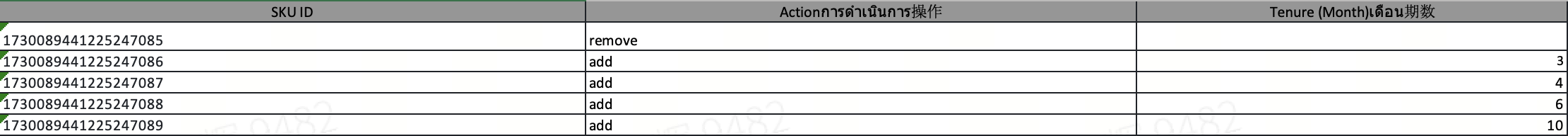

Field | Explanation |

| SKU ID | Fill in the ID of the SKU that sellers want to offer CC IPP. Sellers may find SKU ID in 2 places on the Seller Center: |

| Action | Fill:

|

| Tenure | Fill:

|

All selected SKUs will then appear under installment plan options. Turn on the toggle to offer CC IPP for this list of SKUs. The tenures offered to each SKUs may be different, depending on the information provided in the template.

All selected SKUs will then appear under installment plan options. Turn on the toggle to offer CC IPP for this list of SKUs. The tenures offered to each SKUs may be different, depending on the information provided in the template. *Note: screenshots are for reference only. Actual rates, data and figures differ.

*Note: screenshots are for reference only. Actual rates, data and figures differ.

Fees for Credit Card Installment

Sellers who wish to enable CC IPP for their customers will be charged a credit card installment interest for each successful order, based on the tenure in months and the bank that is chosen.*Note: Other than the credit card installment interest, orders paid via CC IPP, like all orders, are also subject to the marketplace commission fee and transaction fee. Learn more here.

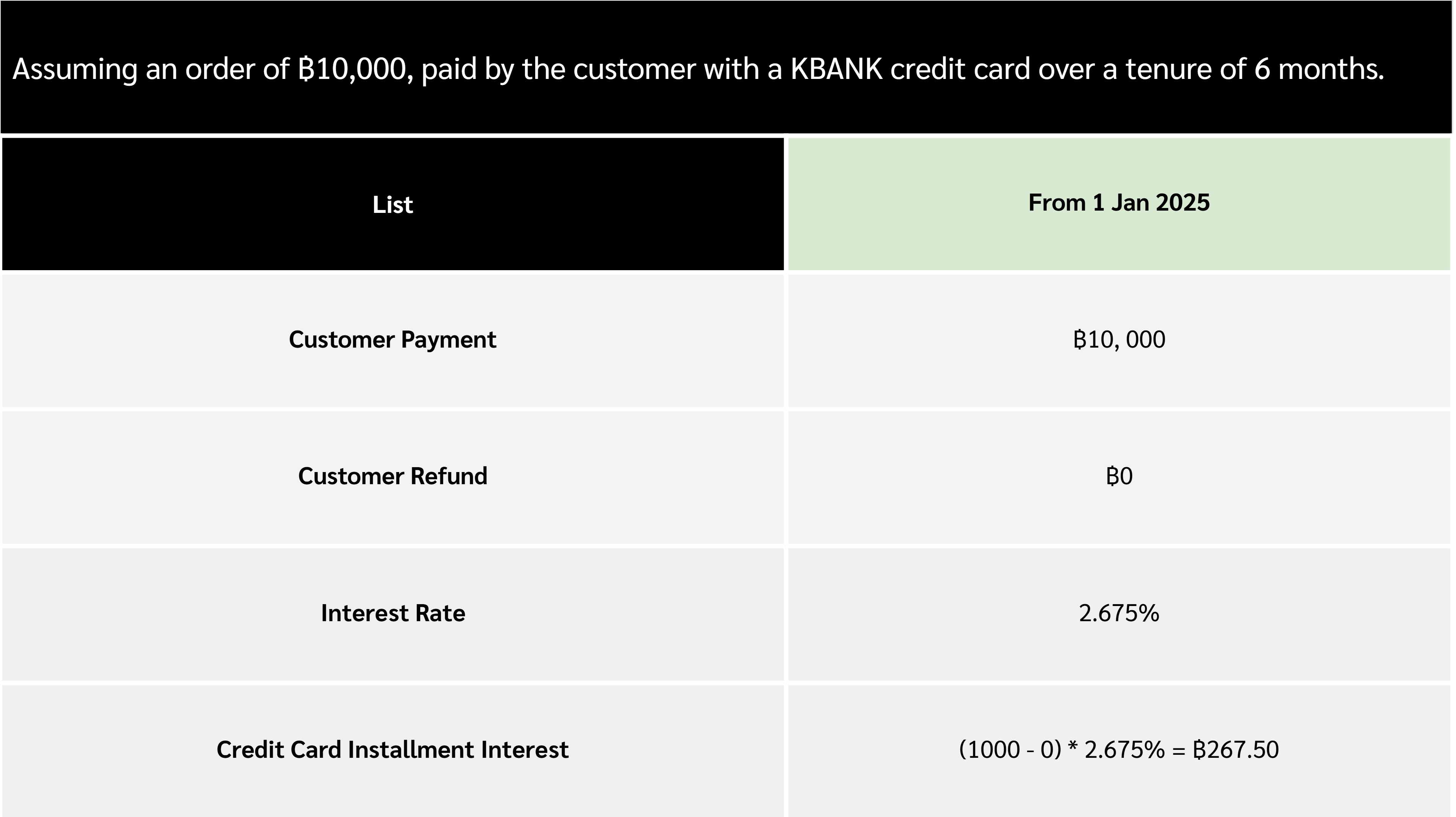

Fee Calculation

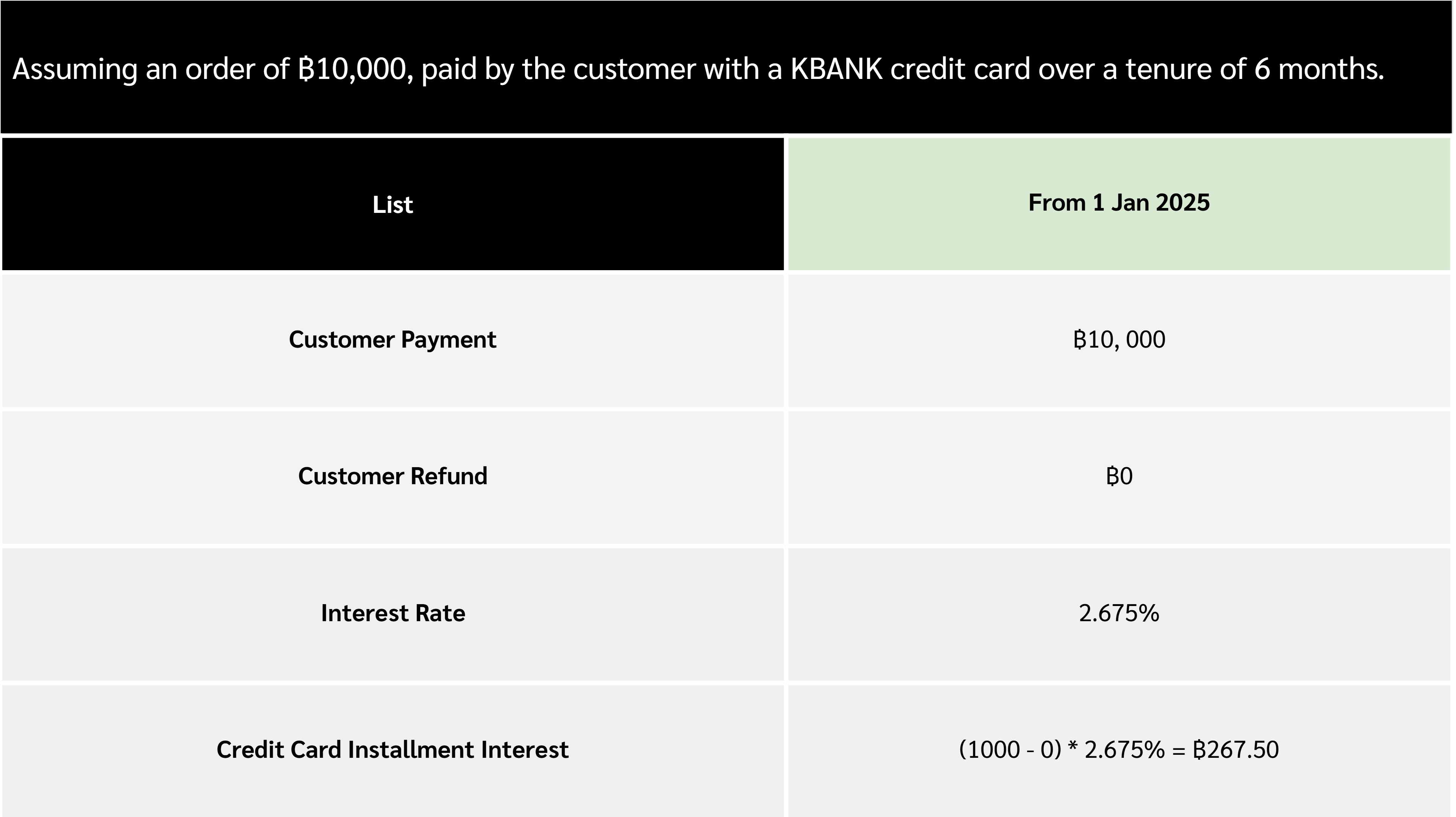

- Formula

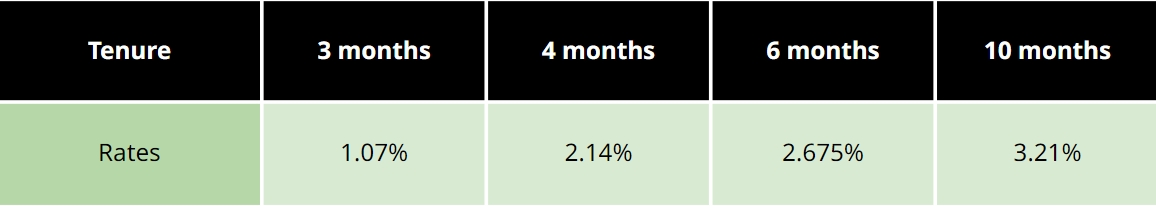

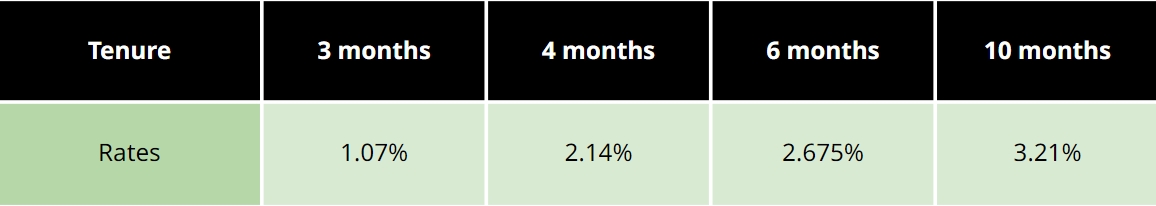

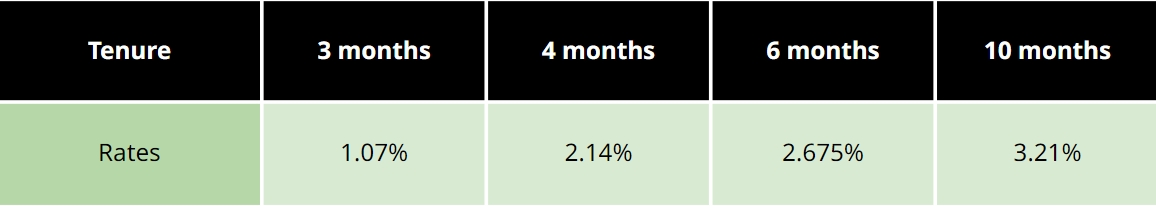

- Interest Rates

- Rates will be fixed per tenor regardless of bank used by customers

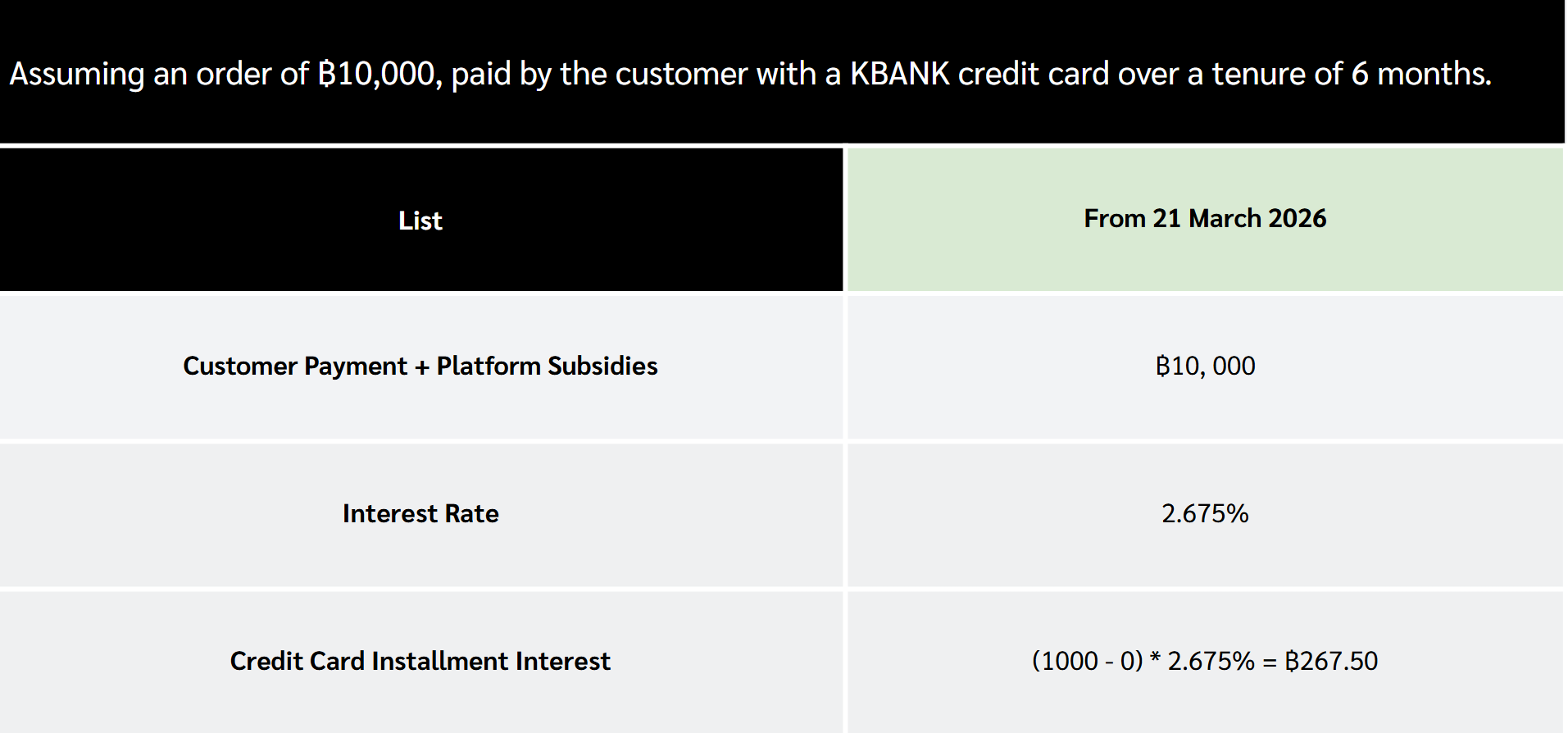

- Calculation Example

*Important Note: The Credit Card Installment Interest is inclusive of Thailand taxes. If you are a tax registered organisation in Thailand and your Tax Code has been provided to and verified by TikTok, we will only collect the amount exclusive of taxes. Learn more here.

*Important Note: The Credit Card Installment Interest is inclusive of Thailand taxes. If you are a tax registered organisation in Thailand and your Tax Code has been provided to and verified by TikTok, we will only collect the amount exclusive of taxes. Learn more here.Fee Details

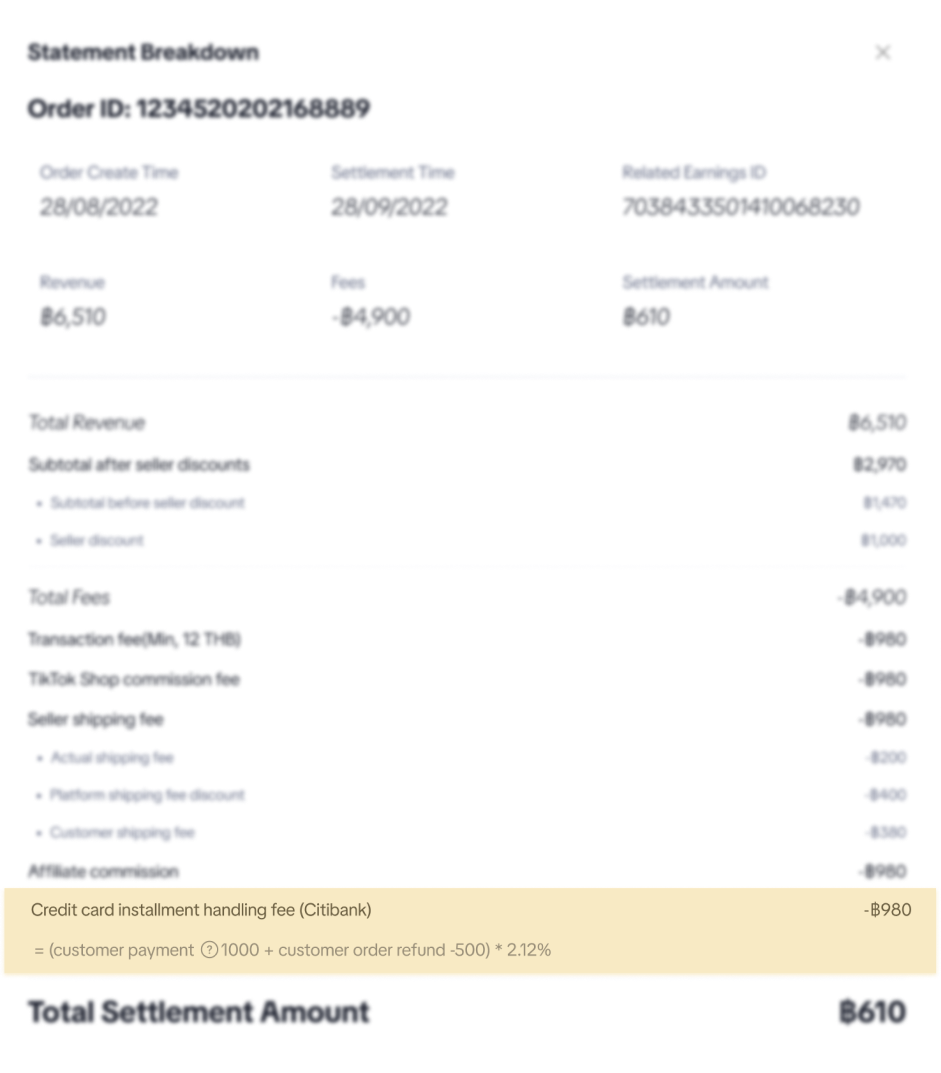

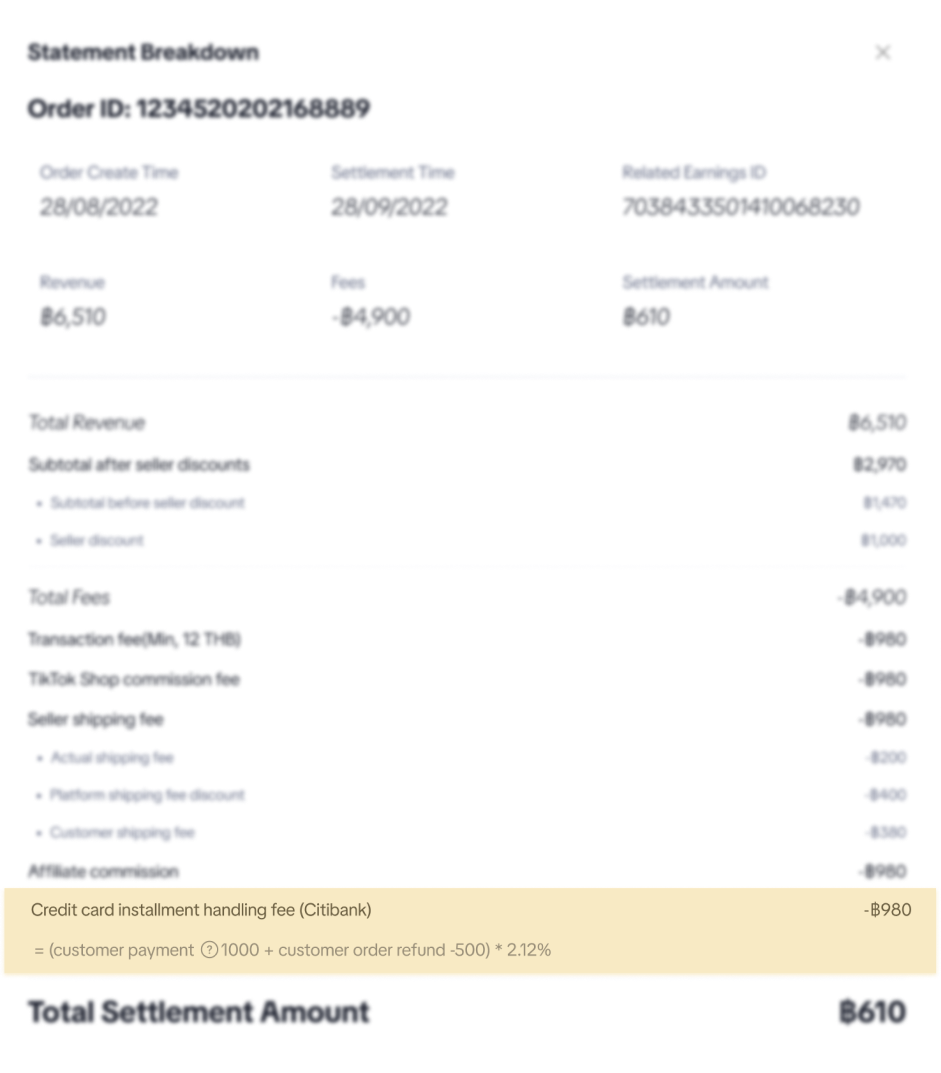

Sellers may find details of their credit card installment Interest in their transaction breakdown under the Finance module of the Seller Center.[This version is apply to calculation logic before 21 March 2026]

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.[Update] Fees for Credit Card Installment

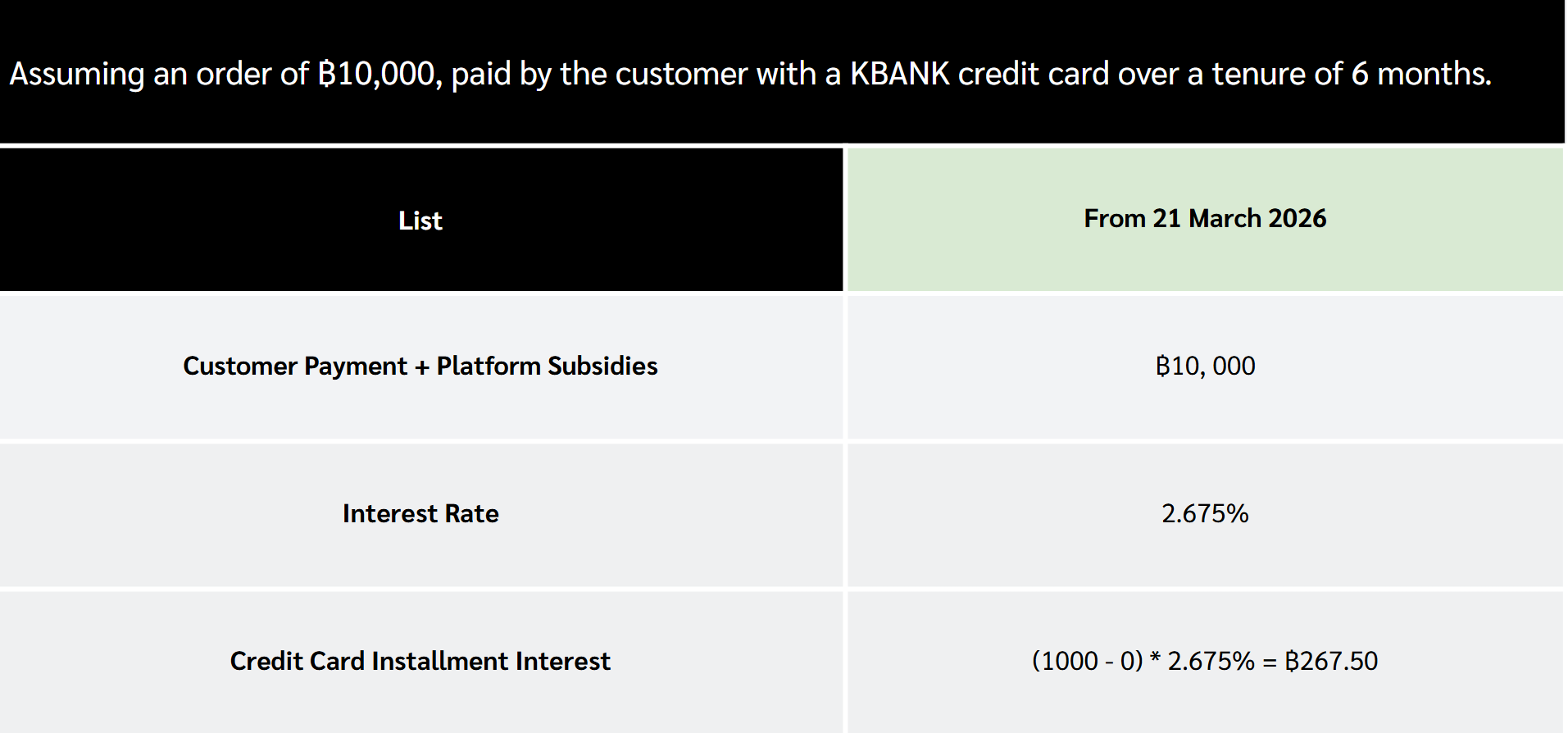

Effective 21 March 2026 onwardsFee Calculation

- Formula

- Interest Rates

- Rates will be fixed per tenor regardless of bank used by customers

- Calculation Example

Fee Details

Sellers may find details of their credit card installment Interest in their transaction breakdown under the Finance module of the Seller Center.

FAQ

- If the customers pay in installments, will the order also be settled to sellers in installments?

- What is the refund process for orders paid via CC IPP for sellers?

- For full refunds, sellers will receive the full amount of credit card installment Interest in their settlement.

- For partial refunds, sellers will receive the amount of credit card installment Interest pro rate to the refunded amount in their settlement.

- For example, an order of ฿10,000 with a credit card installment Interest of ฿450 was qualified for a partial refund of ฿1000.

- A credit card installment interest partial refund of ฿45 will be refunded to the seller.

- What is the refund process for orders paid via CC IPP for buyers?

- For full refunds, once the refund is successfully processed, any unpaid installment will be cancelled. Buyers will receive the full refunds to the credit card with which they made the payment (subject to the actual refund processing time of the issuing bank)

- For partial refunds that has been approved by the seller and platform, buyers will need to select a bank account (not a credit card) to receive their refunds. They will be prompted to select a refund method when they request the refunds. If the refund requests go through, buyers will receive partial refunds in their selected bank account.

- Can sellers opt out of CC IPP?

- What happens if the seller turns off CC IPP while the customer is in the process of placing an order, having already selected the installment payment option?

- If the customer is still on the payment confirmation page, the customer can still proceed with installment payments, even if the seller has turned off this option.

- If the customer exits the payment confirmation page and returns to make the payment again, the installment payment option will no longer be available to the customer until the seller turns CC IPP back on.