Basic Tax Information for Sellers

01/20/2026

This article addresses some of the tax related questions that sellers may have.

Introduction

Logistics Services and the TikTok Shop platform are provided by two different legal entities.- Logistics Services is provided by Thai Happy Logistics Ltd., a locally incorporated company.

- TikTok Shop is provided by

- Before 00:00, August 15, 2024, TikTok Pte. Ltd., a Singapore incorporated company.

- After 00:00, August 15, 2024, TikTok Shop (Thailand) Ltd., a locally incorporated company.

Platform Shipping Fees charged by Thai Happy Logistics

Logistic Services on TikTok Shop in Thailand is provided by Thai Happy Logistics Ltd., which is the appointed entity of TikTok Shop to carry out the fulfillment of delivery services for local-to-local sellers and cross border sellers whose shipping orders from warehouse(s) in Thailand.Withholding Tax

Withholding tax is only applicable to corporate sellers.As per the tax regulation by The Revenue Department of Thailand, Logistic Services provided by Thai Happy Logistics Ltd. to corporate sellers is subject to a 1% withholding tax. To facilitate the flow of the 1% withholding tax, Thai Happy Logistics Ltd. will serve as the withholding agent. Thai Happy Logistics Ltd. will continuously act for and on behalf of the sellers as the withholding tax agent and has authority to proceed with withholding tax obligations with respect to delivery services, withholding tax at source, issuing a withholding tax certificate and submitting withholding tax filing to the Revenue Department.*Note: as the withholding agent on behalf of sellers, Thai Happy Logistics Ltd. withhold tax at the rate of 1%, for and on behalf of the sellers and will remit the withholding tax to the Revenue Department within 7 days of the following month in which the payment is made. In this regard, there is no need for sellers to deduct tax on payments made to Thai Happy Logistics Ltd. and they do not need to issue withholding tax certificates to Thai Happy Logistics Ltd.VAT

As a seller selling on TikTok Shop Thailand, the Shipping Fee that the platform charges is VAT exempted. Therefore, no VAT will be collected in the billing for Shipping Fee.

Platform Service Fees charged by TikTok Shop (Thailand) Ltd.

Before 00:00, August 15, 2024

TikTok Shop's service provider is TikTok Pte. Ltd. Under the Revenue Code Amendment Act (No.53) B.E. 2564 (2021), TikTok Pte. Ltd. is required to collect and remit VAT on the platform service fees from its non-VAT registered customers in Thailand.- If the seller is a VAT registrant in Thailand, please provide VAT ID to TikTok Shop. Please ensure that the VAT ID can be verified against the official database of Thai Revenue Department. The format of VAT ID should be a 13-digit number. Then, platform service fees charges will not include 7% Thai VAT.

- If the seller is not a VAT registrant in Thailand or TikTok Shop do not receive your valid VAT ID, the fees that TikTok Pte. Ltd. charges will be subject to 7% Thai VAT.

- https://www.rd.go.th/fileadmin/user_upload/lorkhor/newsbanner/2021/07/e-service_thai.pdf

- https://www.rd.go.th/fileadmin/user_upload/lorkhor/newsbanner/2021/09/QAs_e-Service.pdf

After 00:00, August 15, 2024

TikTok Shop's service provider is TikTok Shop (Thailand) Ltd., a locally incorporated entity.Withholding Tax

Withholding tax is only applicable to corporate sellers.As per the tax regulation by The Revenue Department of Thailand, services provided by TikTok Shop (Thailand) Ltd. to corporate sellers are subject to a 3% withholding tax. To facilitate the flow of the 3% withholding tax, TikTok Shop (Thailand) Ltd. will serve as the withholding agent. TikTok Shop (Thailand) Ltd. will continuously act for and on behalf of the sellers as the withholding tax agent and has authority to proceed with withholding tax obligations with respect to platform services, withholding tax at source, issuing a withholding tax certificate and submitting withholding tax filing to the Revenue Department.*Note: as the withholding agent on behalf of sellers, TikTok Shop (Thailand) Ltd. withhold tax at the rate of 3%, for and on behalf of the sellers and will remit the withholding tax to the Revenue Department within 7 days of the following month in which the payment is made. In this regard, there is no need for sellers to deduct tax on payments made to TikTok Shop (Thailand) Ltd. and they do not need to issue withholding tax certificates to TikTok Shop (Thailand) Ltd.VAT

TikTok Shop (Thailand) Ltd. is required to collect and remit VAT on the platform service fees from all its registered customers in Thailand.Whether or not the seller is a VAT registrant in Thailand, the fees that TikTok Shop (Thailand) Ltd. charges will be subject to 7% Thai VAT.

Withholding Tax Agent Contract

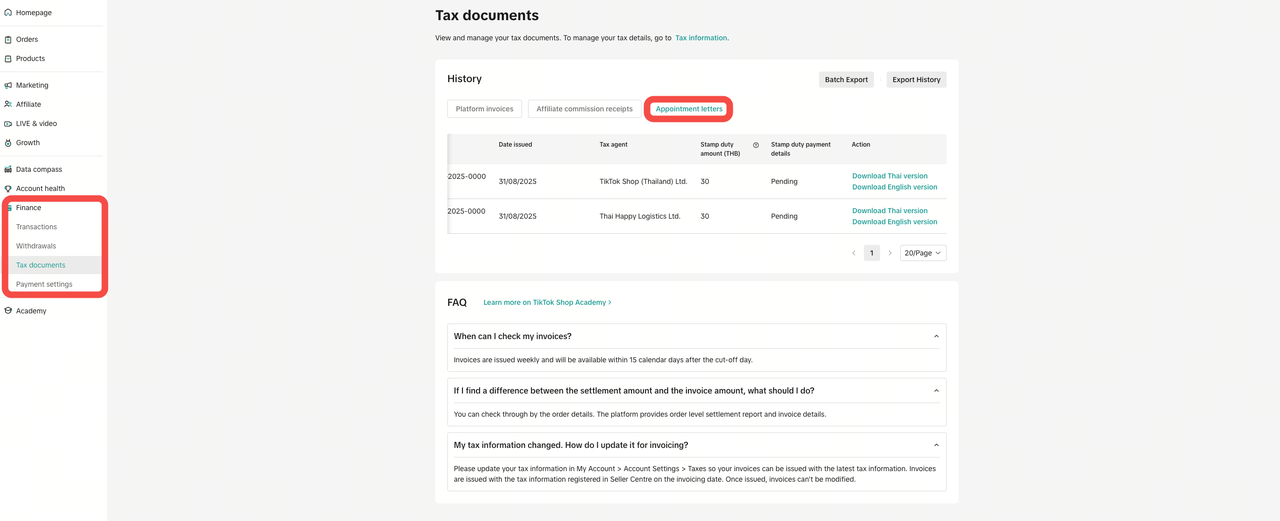

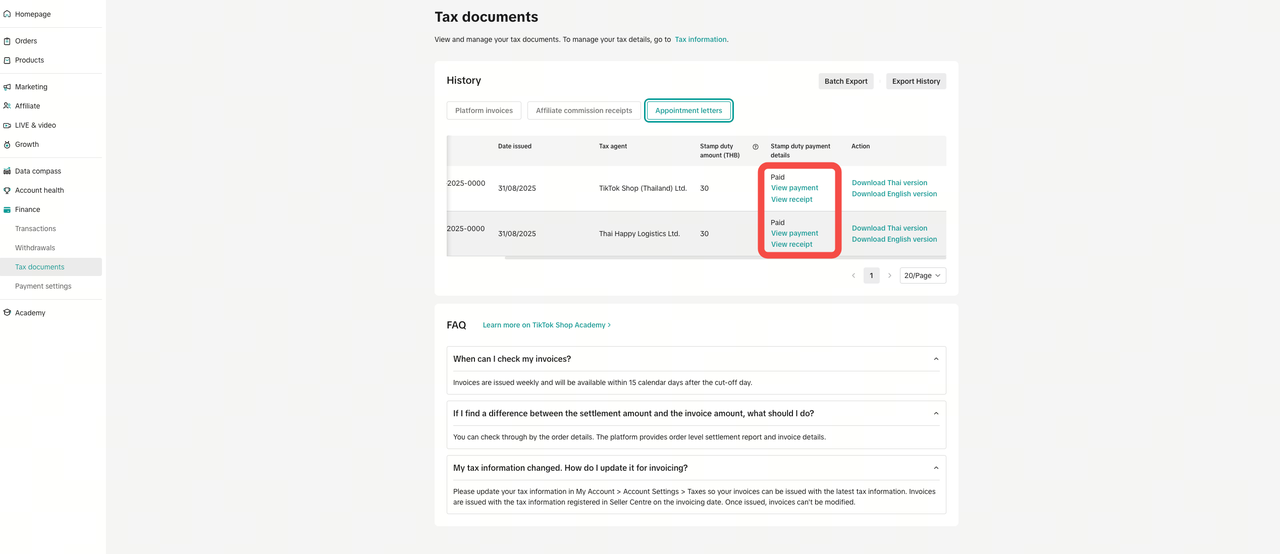

As reflected in the TikTok Shop Seller Terms of Service, local corporate sellers' use of the platform from 1 July 2025 constitutes sellers' acceptance of TikTok Shop (Thailand) Ltd. and Thai Happy Logistics Ltd. being their withholding tax agentSellers can find the two corresponding tax agent contracts on the Seller Center > Finance > Tax Documents > Appointment Letters.

If you can't find your withholding tax agent contract, please contact your Account Manager or raise a ticket to the Help Center.

If you can't find your withholding tax agent contract, please contact your Account Manager or raise a ticket to the Help Center.Stamp Duty

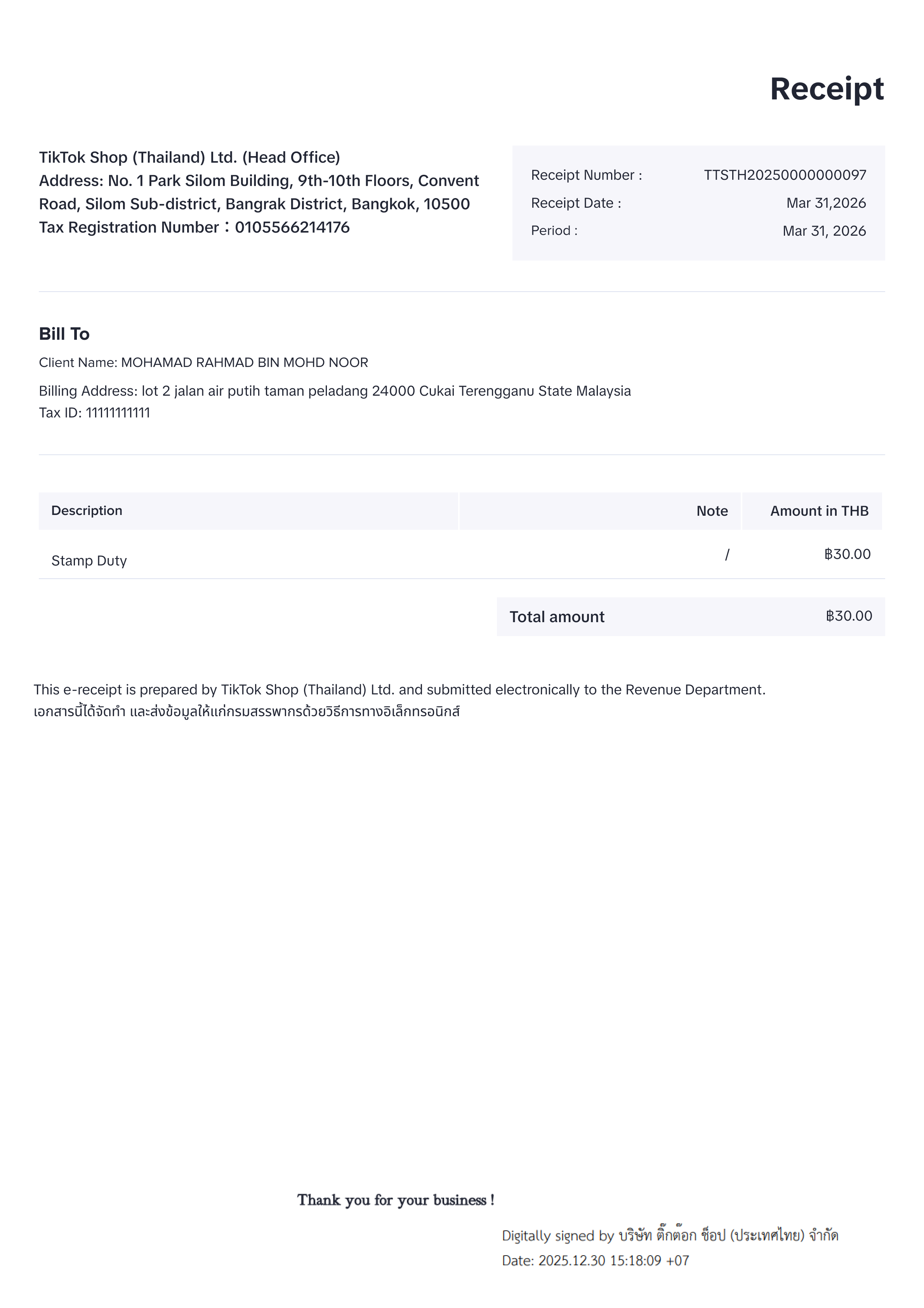

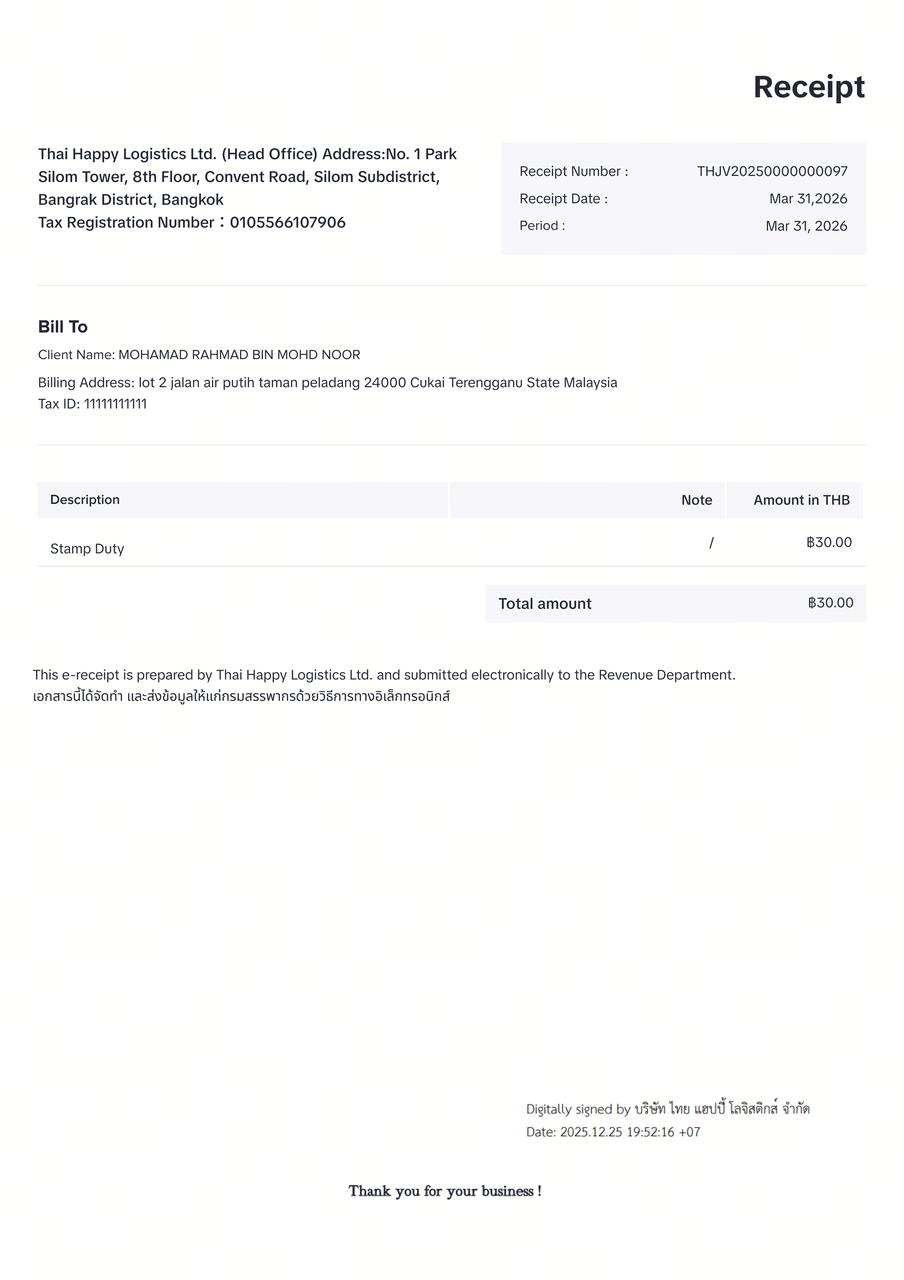

In compliance with Thailand tax regulations, TikTok Shop and Thai Happy will collect stamp duty on the withholding tax agent contracts from sellers and submit it to the Revenue Department on sellers' behalf.The stamp duty is THB 30 per contract, and will be collected on:

- By 15 January, 2026 for sellers whose contracts are dated on and before 31 December 2025.

- Immediately upon contract generation, for sellers whose contracts are dated after 31 December 2025.

- Receipt sample from TikTok Shop (Thailand) Ltd.

- Receipt sample from Thai Happy Logistics Ltd.

FAQs

- Can I get the invoice for the fees paid for Platform Shipping Fee and Platform Service Fees?

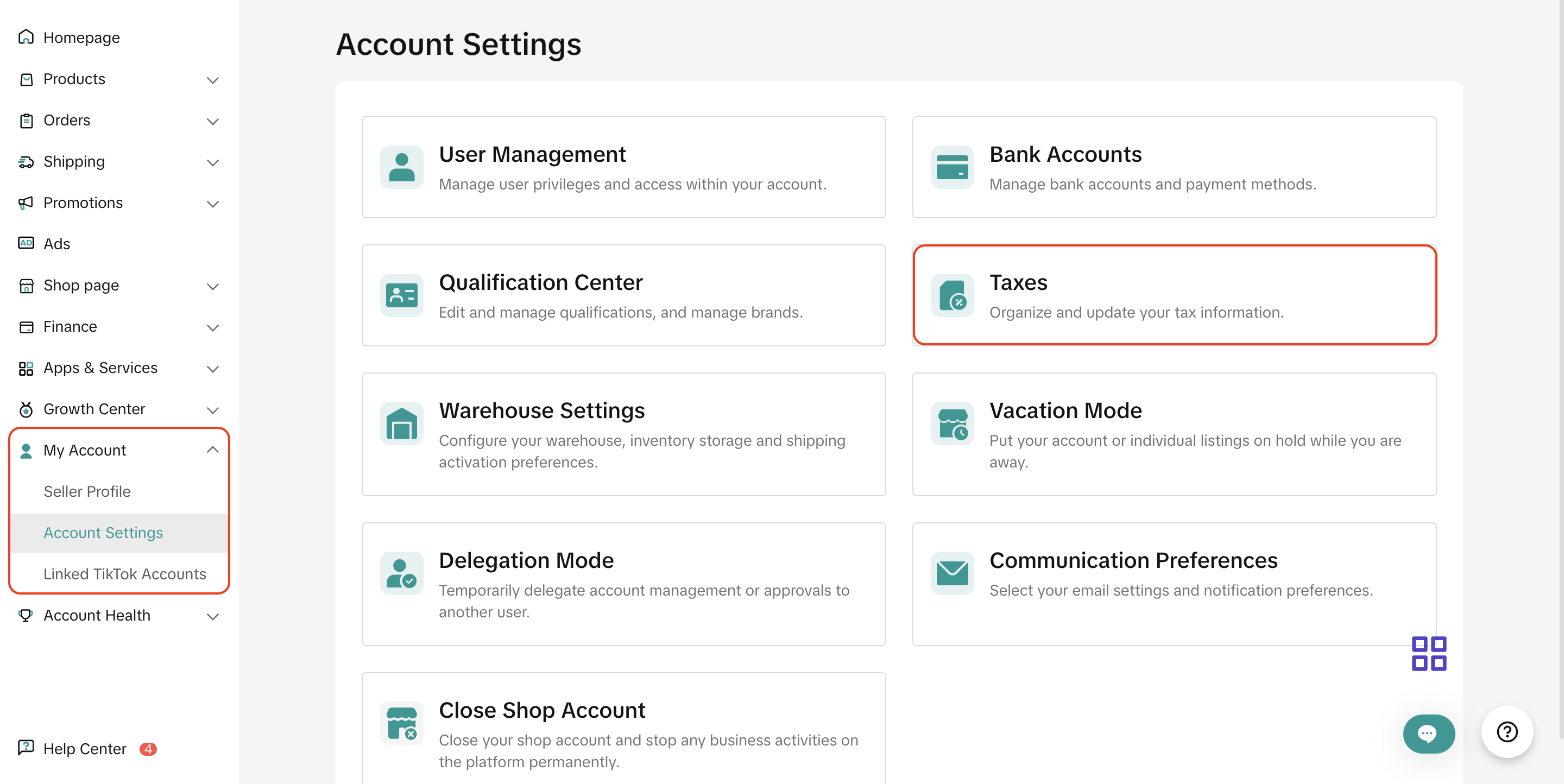

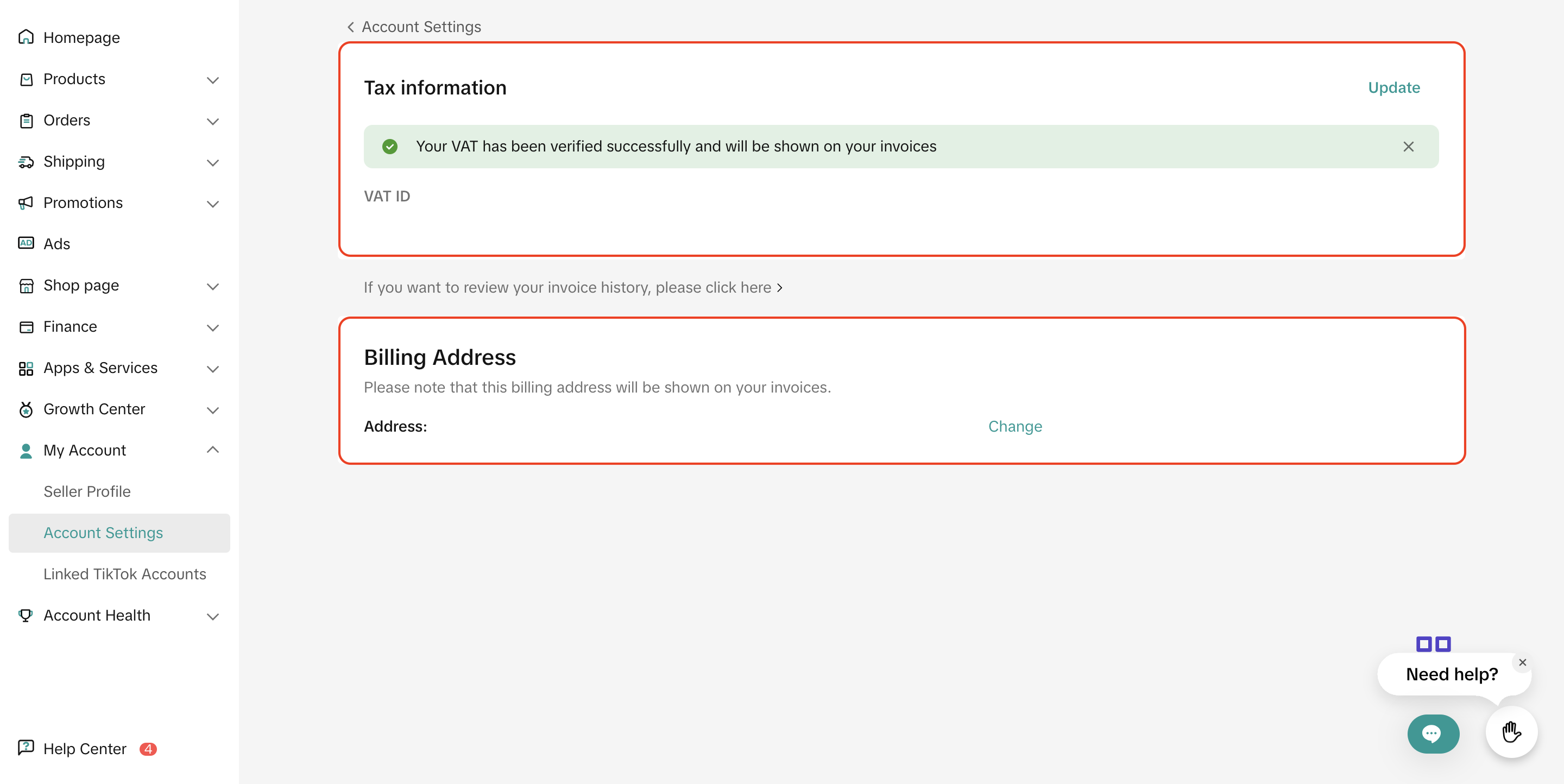

- On Seller Center PC, under Account

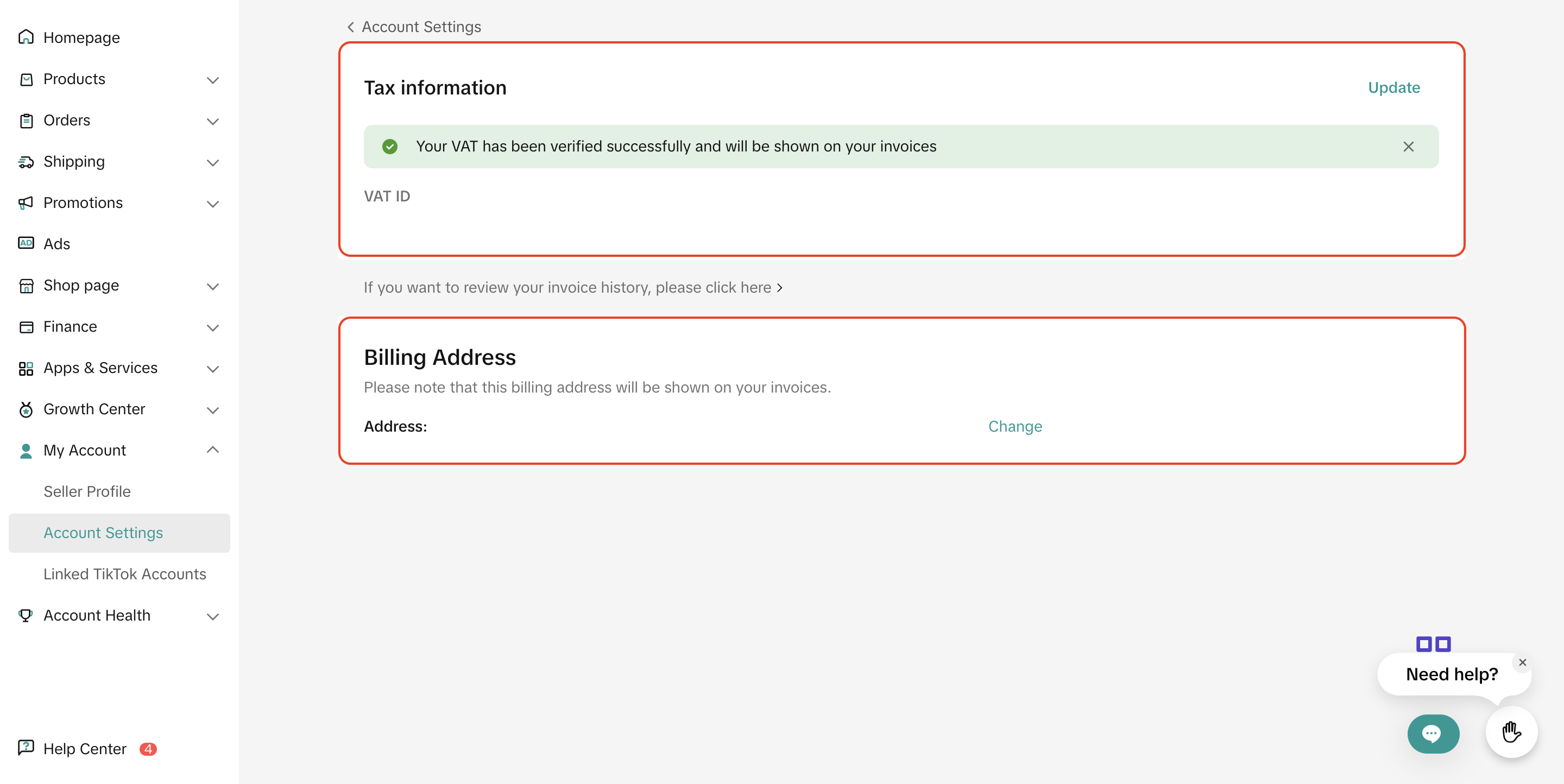

- Fill in your Tax ID and billing/residential address

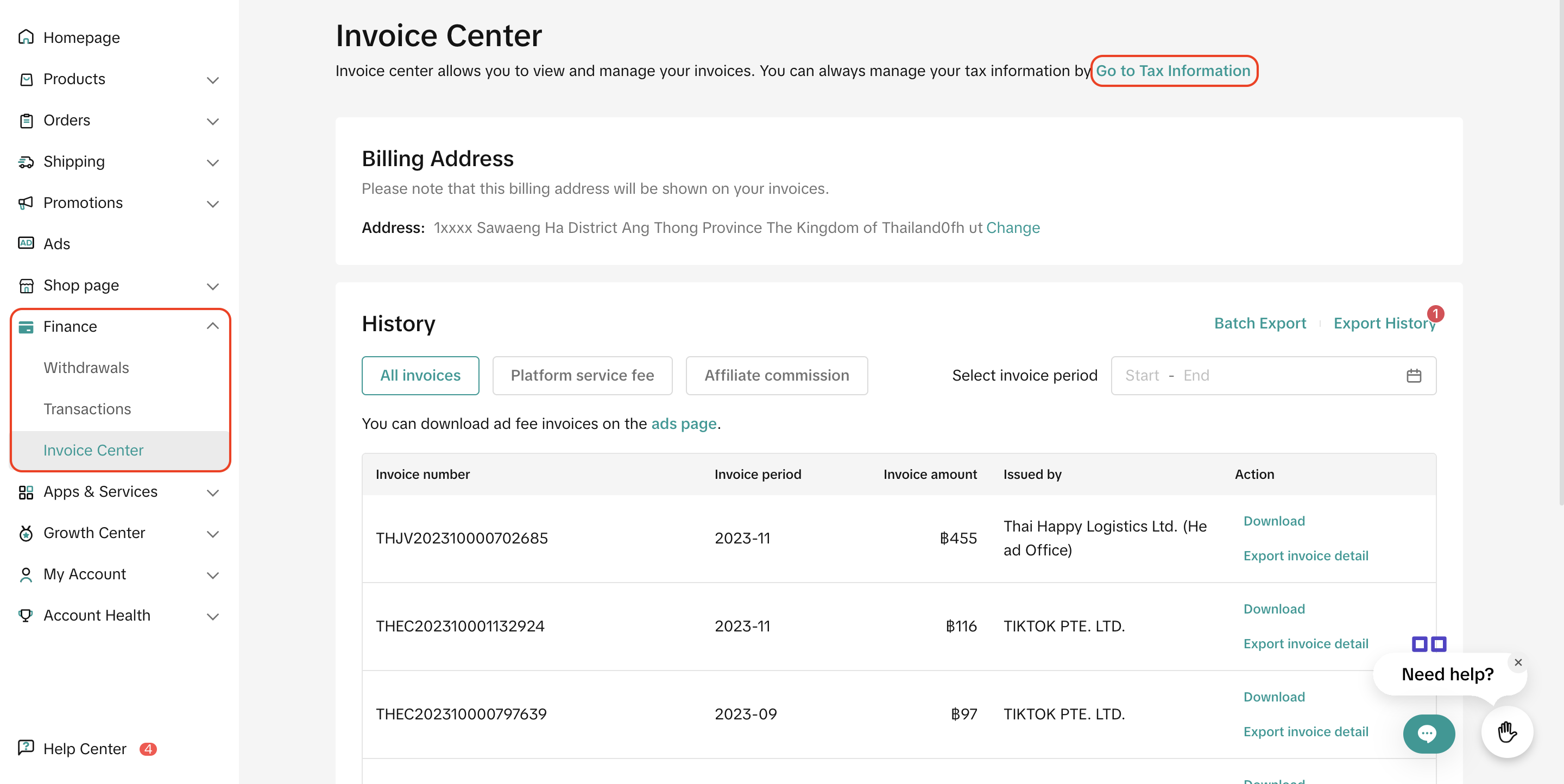

- On Seller Center PC, under Finance

- Go to TikTok Shop Seller Center > Finance > Invoice Center, click on "Go to Tax Information"

- Fill in your Tax ID and billing/residential address

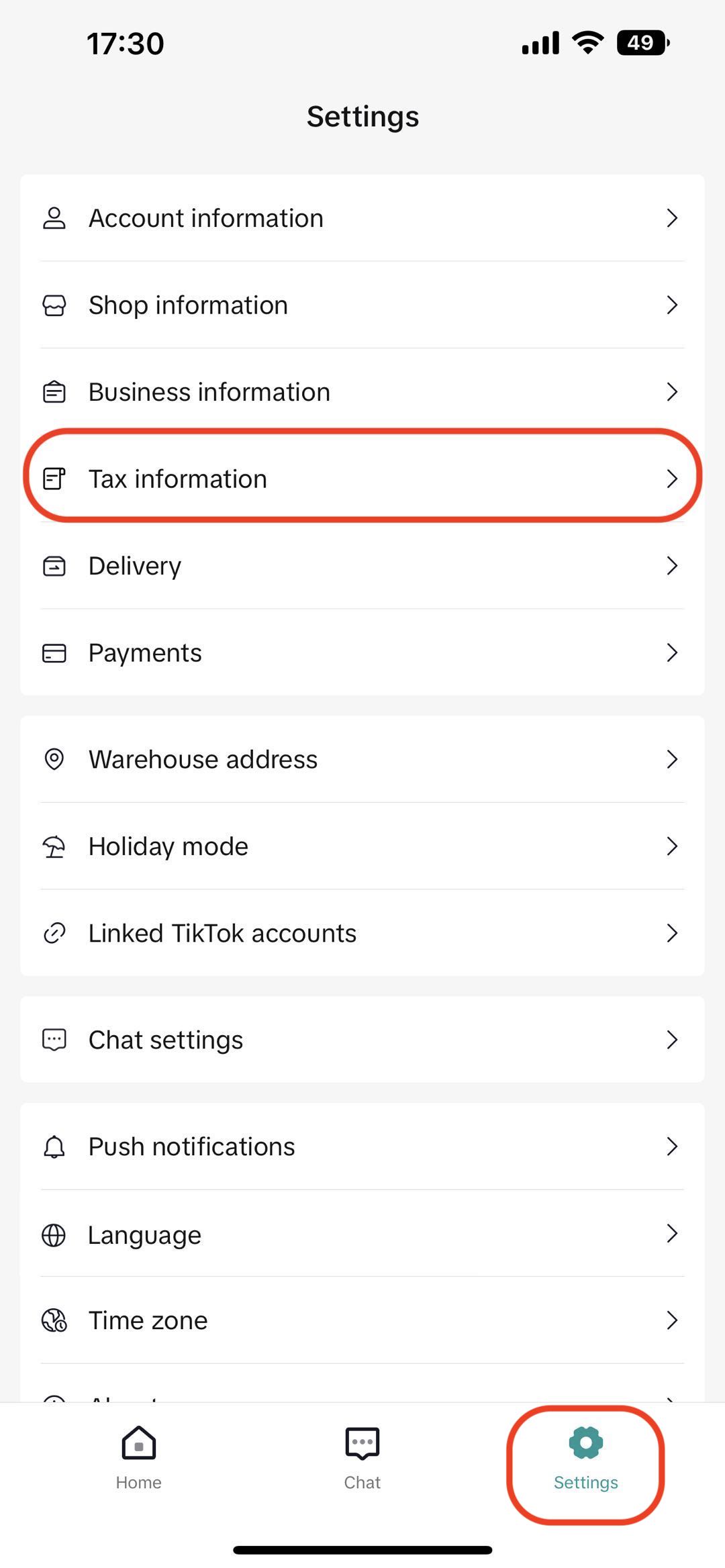

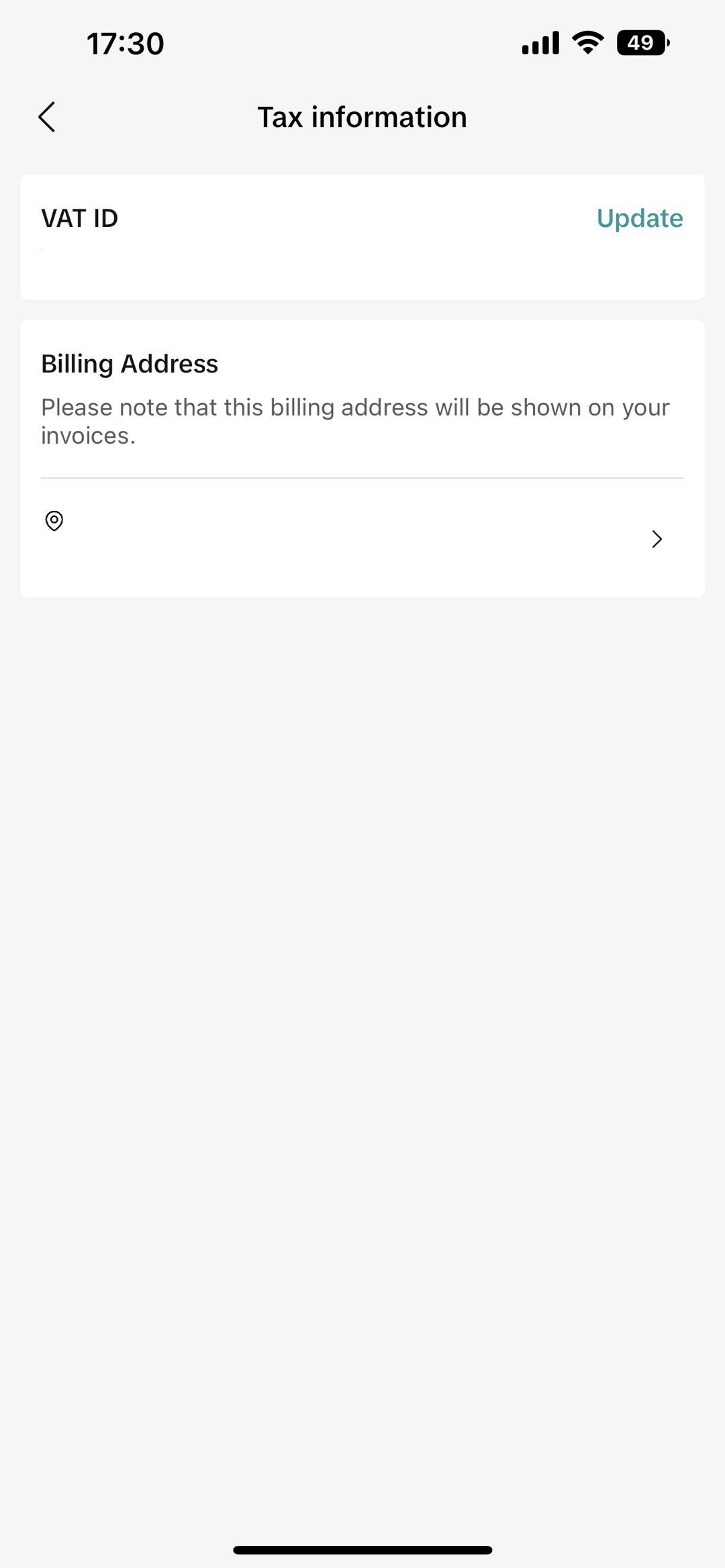

- On the Seller Center Mobile App

- Go to Settings > Tax information

- Fill in your Tax ID and billing/residential address

- I have successfully provided the Tax ID and Billing Address. Where can I get the invoices?

- I understand Platform Shipping Fee is charged by Thai Happy Logistics. Can I know what is the shipping fee rate card?

- As a seller on TikTok Shop Thailand, do I need to issue a withholding tax certificate to Thai Happy Logistics Ltd. or TikTok Shop (Thailand) Ltd.?

Có thể bạn cũng quan tâm về

- 1 lesson

Basic finance module on TikTok Shop

The seller will learn about the different types of fees, binding bank accounts and the process of wi…

TikTok Shop Negative Balance Policy

What is a Negative Balance? Negative balances occur when your account balance has a value below zero…

Why is my order still unsettled?

You can learn more about why your order is unsettled by going to Seller Center, clicking Finance the…

TikTok Shop Seller Settlement Policy

1. Overview 1.1 Introduction The TikTok Shop Seller Settlement Policy has been formulated with the…

Set Up TikTok Shop Withdrawal Password

In order to securely withdraw the settled amount on the seller account balance to the bank account,…

Cash Advance

What is Cash Advance? Cash Advance is a service that allows sellers on TikTok Shop to receive their…

Pay Later Service

From November 7th, 2024, TikTok Shop introduces Pay Later Service, allowing customers to split their…