Easy E-Receipt 2.0

01/07/2025

What is Easy E-Receipt 2.0?

Easy E-Receipt 2.0 is an economic stimulus program by the government allowing individual taxpayers (excluding ordinary partnerships or non-juristic bodies of persons) to deduct up to 50,000 THB from their taxable income for purchases of goods and services in Thailand that meet specific conditions. This deduction applies only to purchases for which an e-Tax Invoice or e-Receipt is issued. These receipts can be used to claim personal income tax deductions for the tax year 2025Example of “Easy E-Receipt” Tag: The tag will be displayed on products that have had sales* *Sales within the last 30 days.A sample of the tag your store will receive *The appearance of the tag on your product may be change.

*Terms and conditions apply.⚠️ Note: The "Easy E-Receipt" label will appear on your products (as shown in the example) from January 16 to February 28, 2025.

*Terms and conditions apply.⚠️ Note: The "Easy E-Receipt" label will appear on your products (as shown in the example) from January 16 to February 28, 2025.Conditions of the Government's Easy E-Receipt 2.0

The government-approved tax deduction is applicable to purchases made between January 16 and February 28, 2025, with the deductions to be claimed in early 2026. Eligible individuals can deduct up to 50,000 THB under the following conditions:Eligible Products for Tax Deductions under the Easy E-Receipt 2.0

Even if the seller is not a VAT-registered operator, the following goods and services are eligible for tax deductions when issued with an electronic receipt:- Books, Newspapers, and Magazines

- Includes physical books, newspapers, and magazines.

- E-books

- Service fees for books, newspapers, and magazines in electronic form are accessed via the Internet or as E-books.

- One Tambon One Product (OTOP)

- OTOP products are registered with the Community Development Department.

- Products or services from community enterprises registered with the Department of Agricultural Extension.

- Products or services from social enterprises registered with the Office of Social Enterprise Promotion.

Ineligible Goods and Services for Tax Deductions under the Easy E-Receipt 2.0

The following are not eligible for tax deductions under the Easy E-Receipt 2.0 program:- Alcohol, beer, and wine.

- Tobacco products.

- Fuel, gas, or electric vehicle charging services.

- Cars, motorcycles (including motorized bicycles), and boats.

- Utility bills (water, electricity, telephone, and internet).

- Services with agreements extending beyond the program period.

- Non-life insurance premiums.

How to join the Easy E-Receipt Campaign

For Sellers Wishing to Participate in the Easy E-Receipt Campaign

Note: TikTok Shop reserves the right to revoke the Easy E-Receipt label if the seller is unable to issue a tax invoice to the buyer.

- The Shop must confirm that it can issue full-form electronic receipts or tax invoices through the Revenue Department's e-Tax Invoice & e-Receipt system.

- The seller must request an easy e-receipt campaign via this FORM

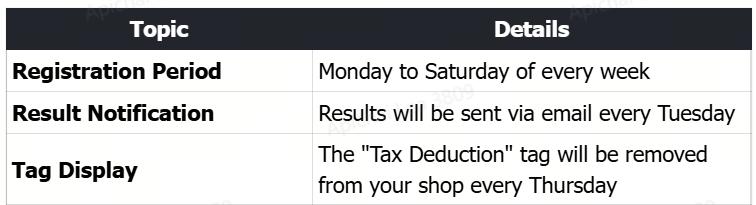

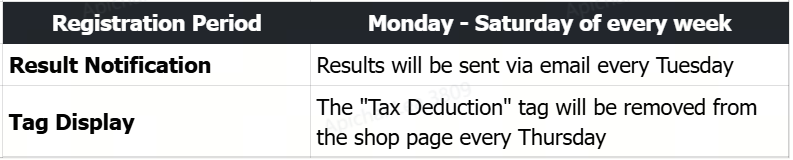

- All registration (both opt-in and opt-out requests) will be reviewed every Monday.

- If they register successfully, sellers will receive email confirmation by Wednesday.

- Upon meeting the criteria, the system will display the "Easy E-Receipt 2.0" label for your shop.

For Sellers Wishing to Opt Out of the Easy E-Receipt Campaign Label

- Seller can opt out of the easy e-receipt campaign via this FORM

- All registration (both opt-in and opt-out requests) will be reviewed every Monday.

- If they register successfully, sellers will receive email confirmation by Wednesday.

- If you request to disable leaving the program, your shop will automatically be removed from the Easy E-Receipt campaign.

Note:

Note:- Sellers registered for Value Added Tax (VAT) are responsible for preparing and issuing tax invoices to buyers.

- You can review the conditions of the Easy E-Receipt program [here].

- To issue full-form electronic receipts/tax invoices (e-Tax Invoice & e-Receipt), sellers must first submit a request to the Revenue Department and ensure the issuance is done through the system specified by the department. Learn more [here].

- Questions and answers (Q&A) regarding the "Easy E-Receipt" program can be found [here].

- Shops are responsible for handling personal data in compliance with the Personal Data Protection Act 2019 and other applicable data protection laws. TikTok Shop is not involved and/or responsible for these data management processes.

- Other criteria, terms and conditions will be set by the Revenue Department and/or other related authorities.

You may also be interested in

- 1 lesson

How to join campaign on TikTok Shop

Sellers will learn about "the types of TikTok Shop campaigns" and delve into the correct "steps to j…

Livestream Campaign

Livestream Campaign This article teaches you how to use Livestream Campaigns to increase traffic an…

Health & Beauty Sellers: Campaign Season Policy Tips & Trick…

Show off your best glow this campaign season. Follow these tips to avoid violations, boost your sal…

Featuring LIVE Specials

This article teaches you how to feature your LIVE Specials Vouchers through your Official and Market…

LIVE Specials

LIVE Specials This article teaches you what LIVE Specials are, how it works, as well as how the LIV…

Understanding Payments

This article introduces the different payment methods available for our Marketing Benefits Packages.…

Campaign Registration with GMV Max

GMV Max is now integrated directly into campaign registration and is a requirement for participation…